eylons is a long list of short posts describing the founder's experience, perspective, and advice on various entrepreneurship aspects

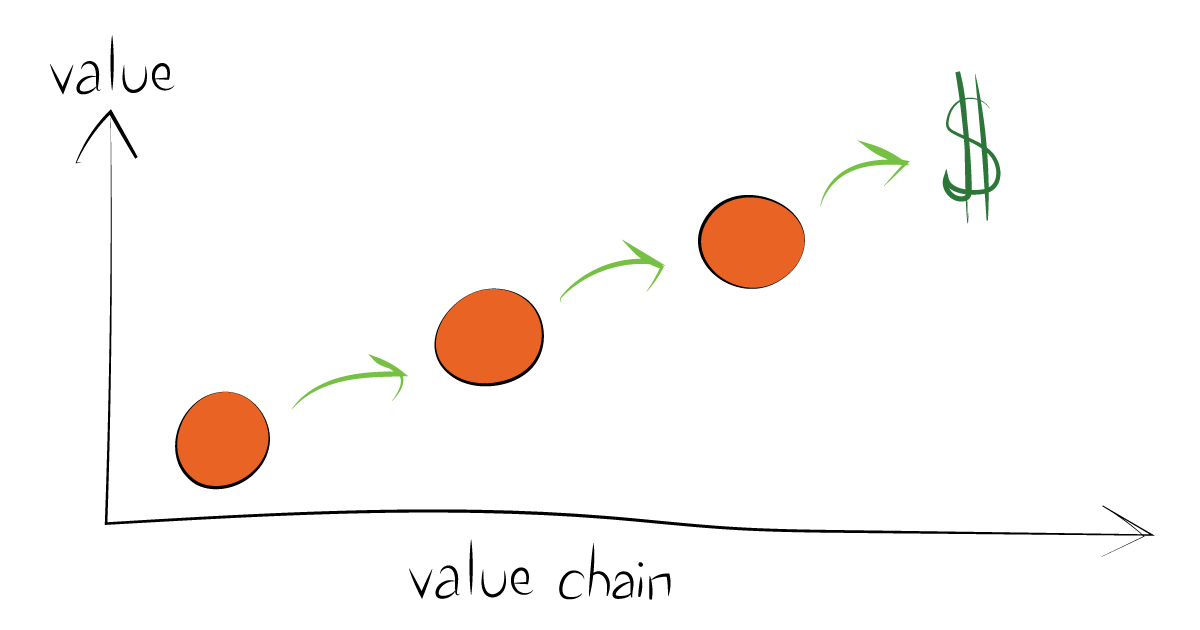

The huge value for products that “touch the money”

I like this FinTech phrase “touch the money”, and this straightforward test categorizes any product or service according to this yes/no question: do you touch the money?

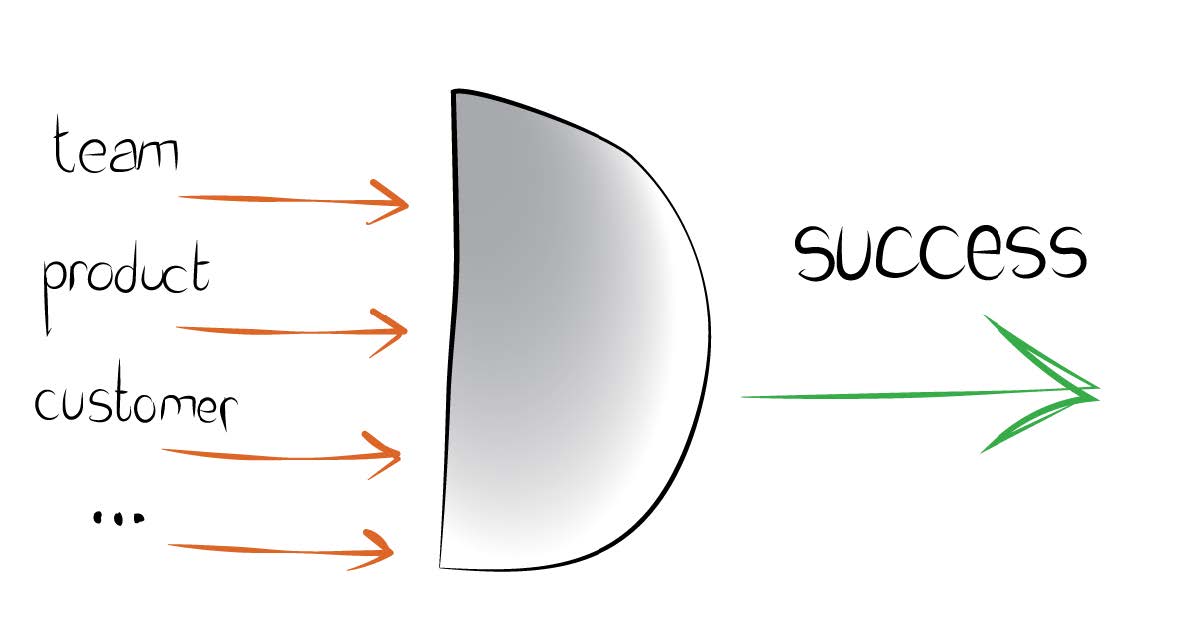

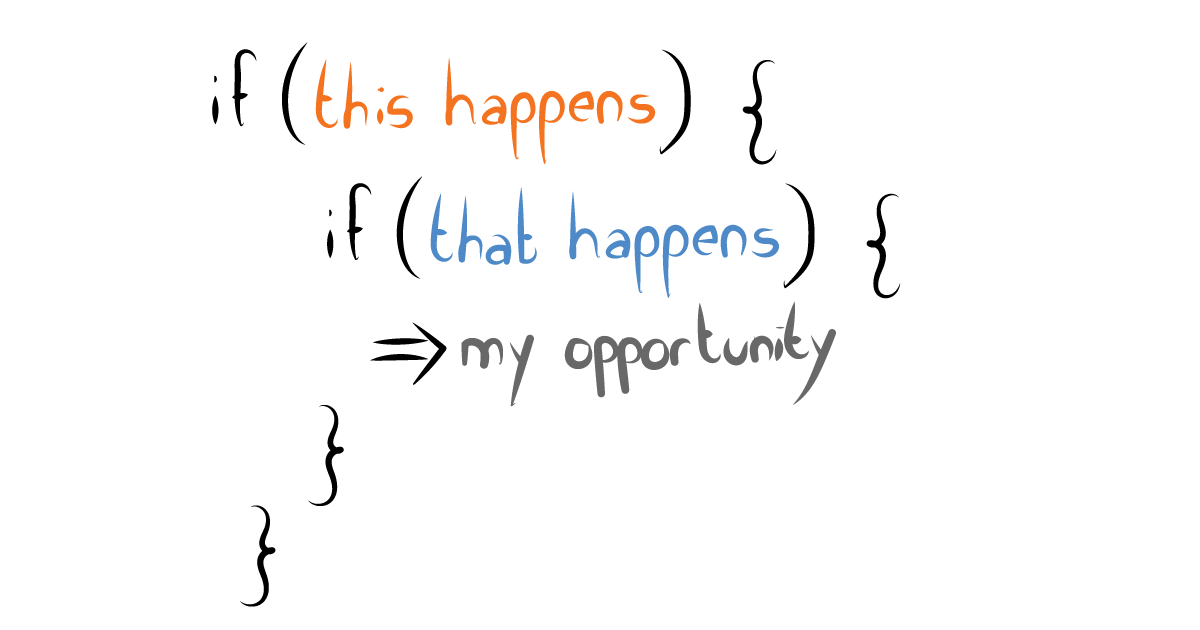

Logical AND for start-up success

“Logical AND” is the best answer I can give to the challenging question: how can you explain an entrepreneur that succeeds in his first company and then fails? “Logical AND” is also my best explanation of why startup success is so damn hard.

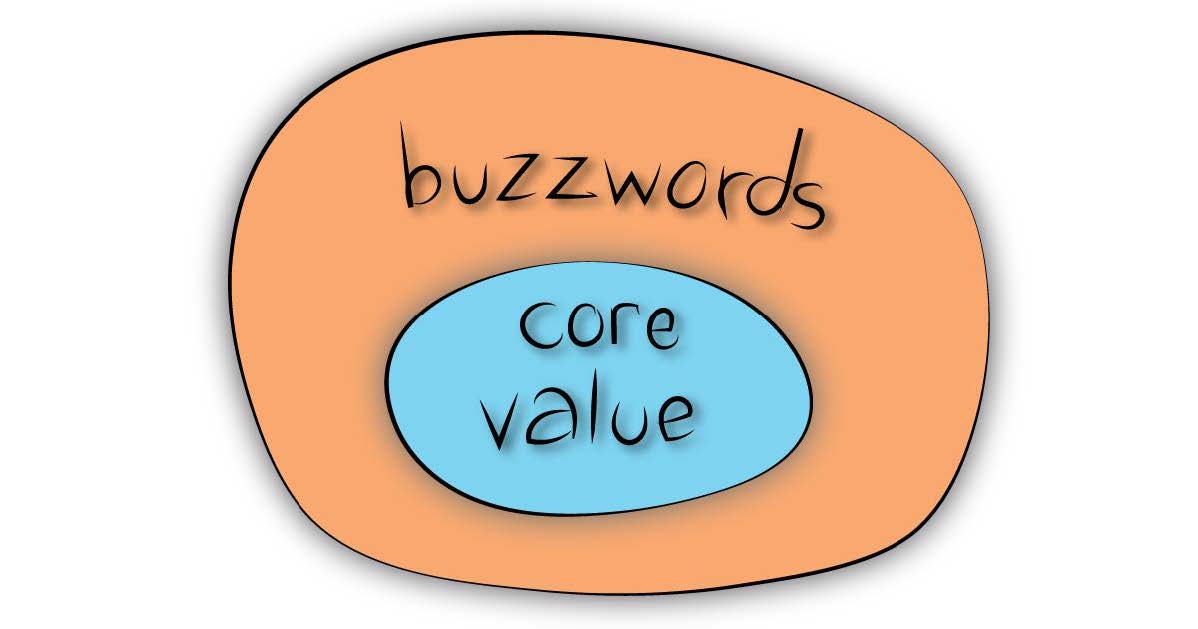

What is traction? (and why this tests how brave you are)

Too often I have been angry and disappointed to hear people talking about “traction” without any thought given to its meaning. Clearly, traction is not only ‘users’, ‘traffic’, or other entries in the long dictionary of buzzwords. I need to think, and to feel confident with my version of what the hell is “traction”?

Becoming a domain expert in the new domain you’re creating

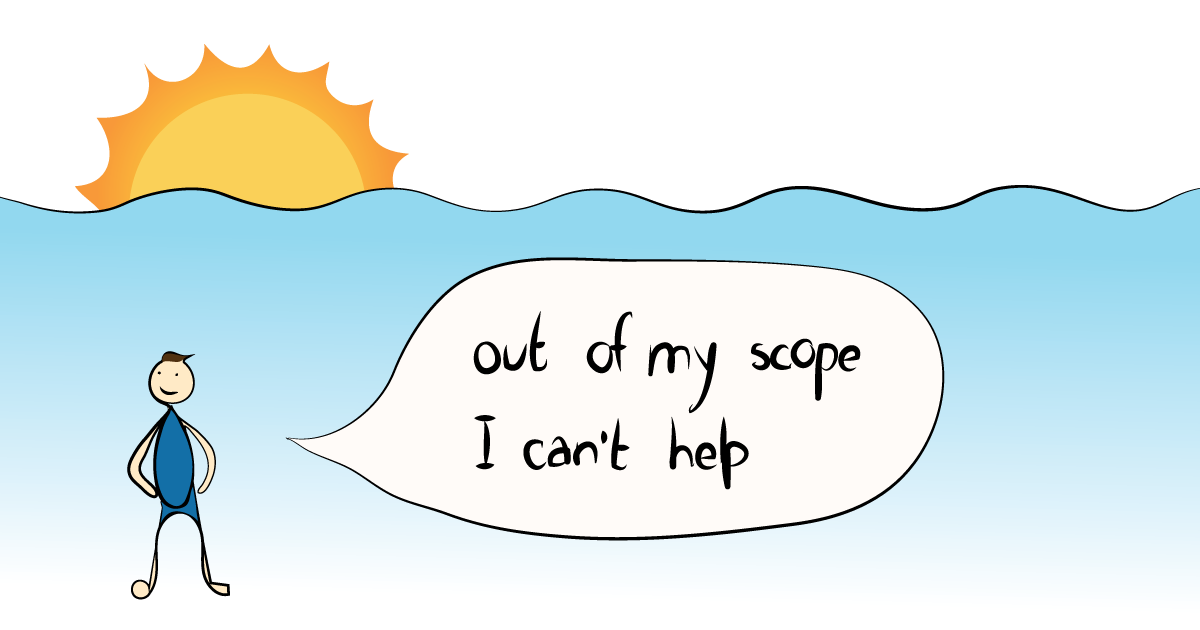

When you start something new, your domain doesn’t exist. It’s not defined and nobody covers it. It’s most likely that your new invention is a don’t-care subset of a few large markets. While it’s wrong to target domain expertise in those large (“Financing”, Mobile”, “Agriculture”, etc.) markets, becoming a domain expert in the new domain you’re creating should be one of your long-term targets.

What’s the agreement co-founders MUST sign on day one?

All weddings are happy, and all founders are in love on day one. But things may change, and if the founders didn’t define the proper mechanism for breaking up nicely, a lot of time and money (and perhaps a few tears) will be needed to move on. This is why “reverse vesting” MUST be accepted and signed-off at the beginning of the journey.

”Insanity is doing the same thing over and over again and expecting different results”

― Albert Einstein

Unfortunately, an innovative idea will need an innovative business model

You’ll say that while your product is purely innovative, luckily, your business model is both simple and aligned with your customer operations today. Unfortunately, this is probably not true… new product requires a lot more than new pricing, and it takes time and iterations to figure out the right business model.

Challenge your in-depth assumptions. Unfortunately, they are probably wrong

There is a lot of discussion about current numbers and forecasts of the future, with nice-looking dashboards making this favorite pastime of management teams seem simple and straightforward. However, assumptions are not discussed and challenged enough. The problem here is that, most probably, what you take for granted is wrong.

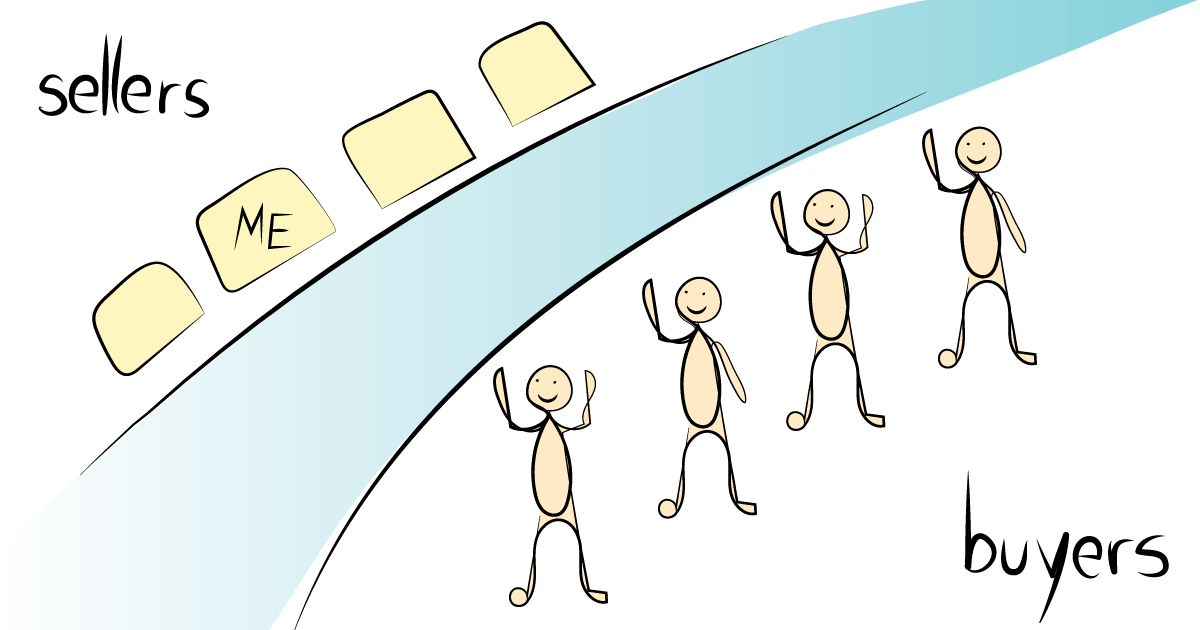

Want very large companies to distribute your product? Forget about it – unless…

You’ll need to make the initial direct sale to the end customer, and you’ll need to prove that this customer is both a valid indicator for others + in love with your product. With this asset in your hands, you can start developing a business with large companies as your channels. In other words – no shortcuts…

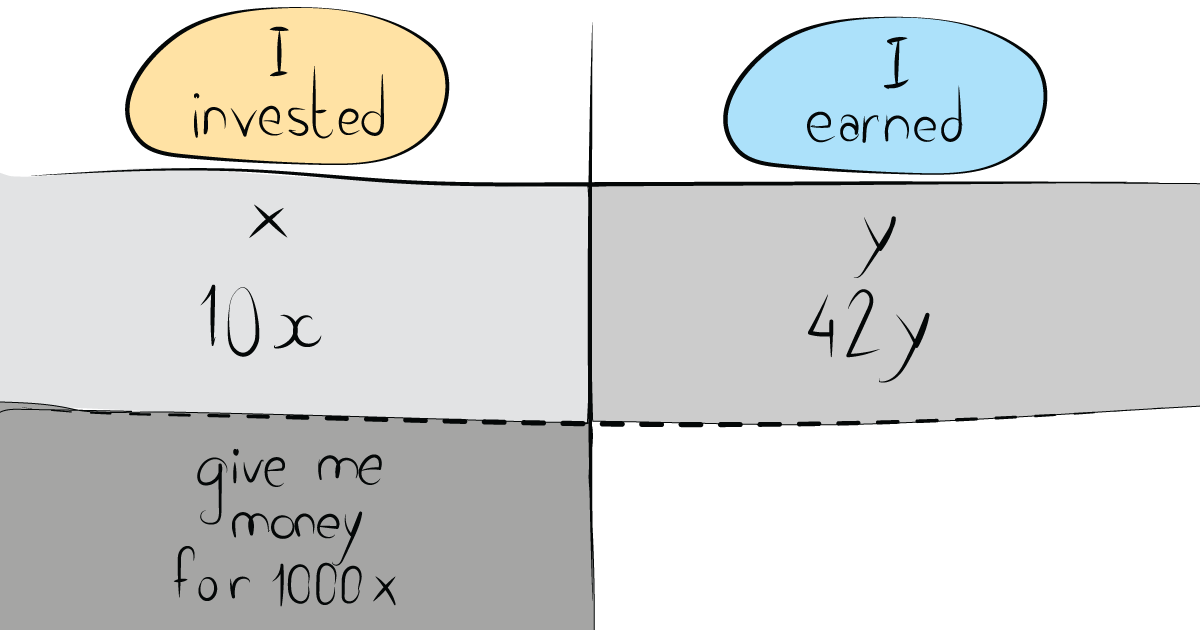

Pitch based on economical Customer-Acquisition-Cost (CAC) is extremely powerful

“I already invested X and got Y (hopefully, X and Y are US dollars), and then I did it again with 10X and got 42Y, non-linear growth. Now I’ll need your funding to do 1000X.” This statement is the best possible pitch! You’re probably not there, but in your mind and your work – try to get there.

Product market fit is not so much more than a marketing buzzword for investors

Sell “product market fit” for anyone who wants to buy it. But keep in mind that the customers probably don’t represent the target market, and the actual product maturity is perhaps 10% of what you say. Even if there is a temporary hit between the product and a few early adopters, many risks remain and a ton of work still needs to be done before readiness to grow.

Physical presence matters, a lot

Everything is a local business – because of (lack of) trust. And a physical handshake is still the best way to show commitment. Much of this is also true for online businesses.

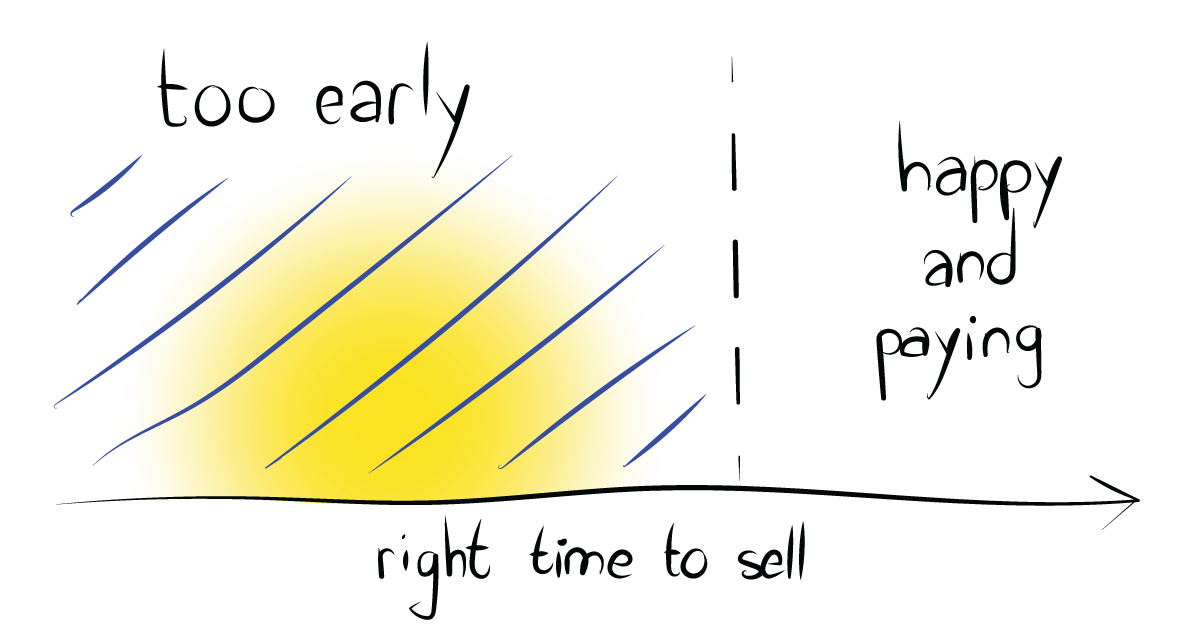

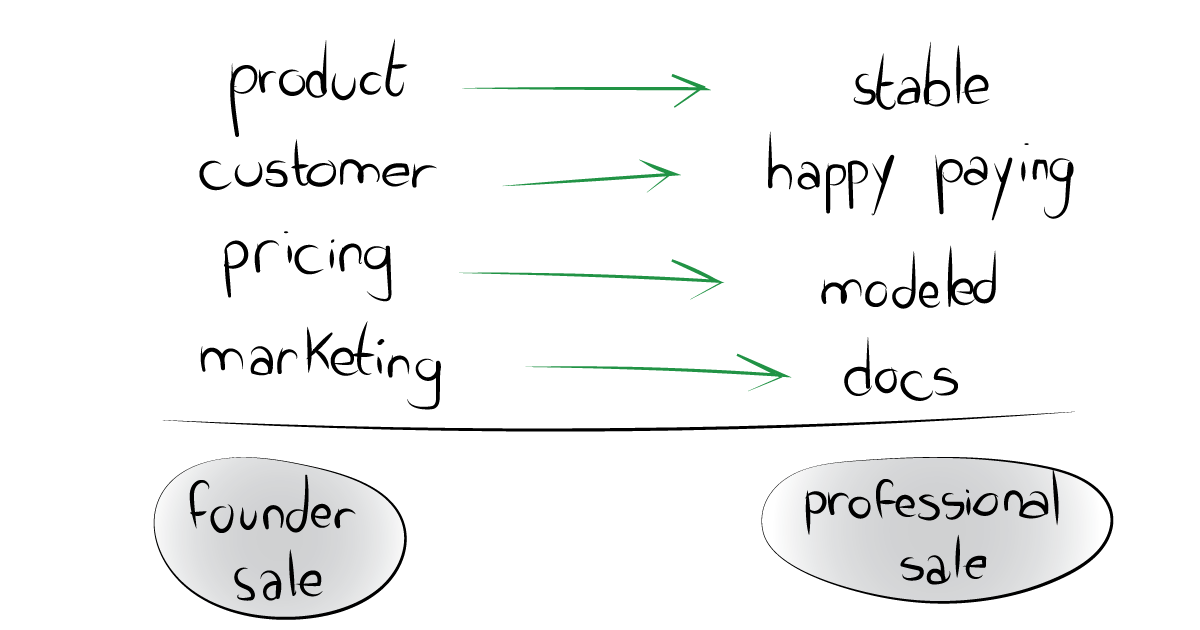

Don’t sell before you know you’ll end up with a “happy paying customer”

When is the right time to sell? When you can commit to generating both happy AND paying initial customers. Happy but not paying is not enough and paying but not being happy is even worse.

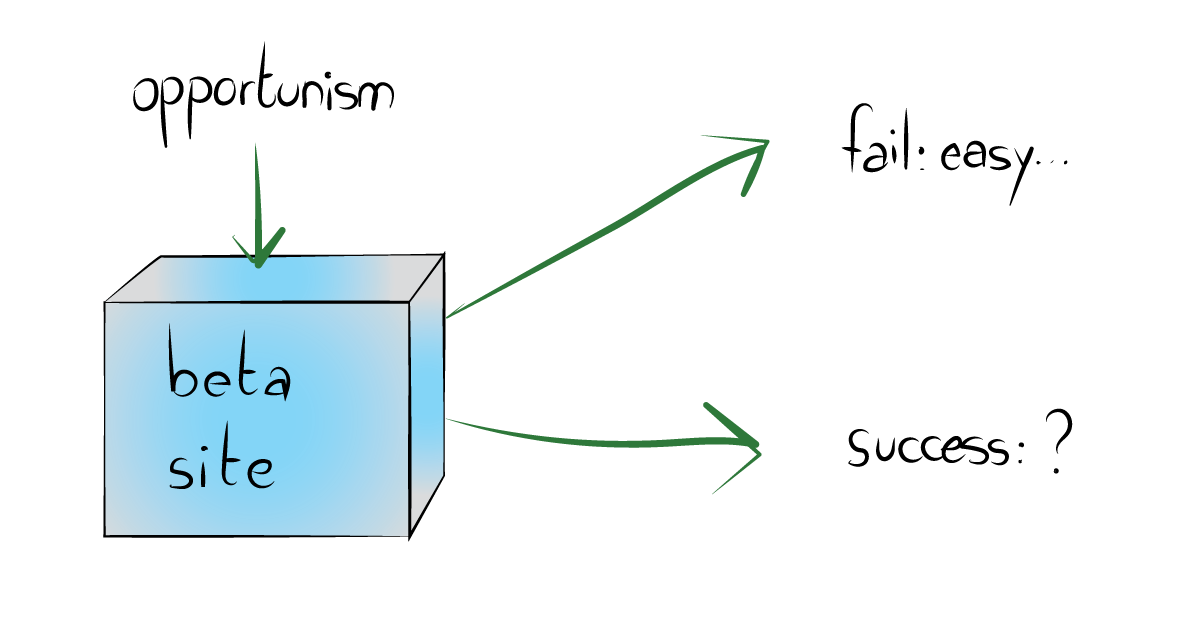

Choose your beta site carefully since it may become a successful event – and now what?

Losers will say something like: “yes, it’s only a beta test for a product that’s not there, with a customer that’s anyway not the dream, so no big deal if this fails, we’ll still learn something.” On the other side, a plan for success starts as early as chasing after the right beta site, with no intention to screw up.

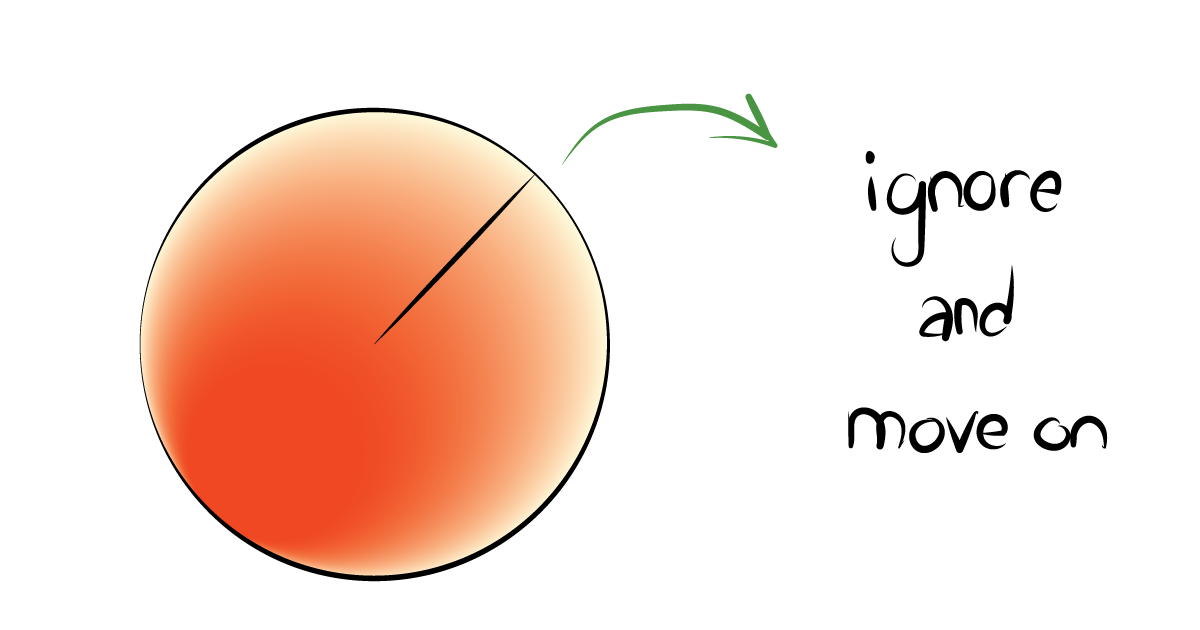

99% is 100%. Take the decision and move forward

Miracles and lottery wins happen, but dreaming should not be a strategy. Execution/decision making is to take the 99% probability and to move on. And to do it fast, without looking back.

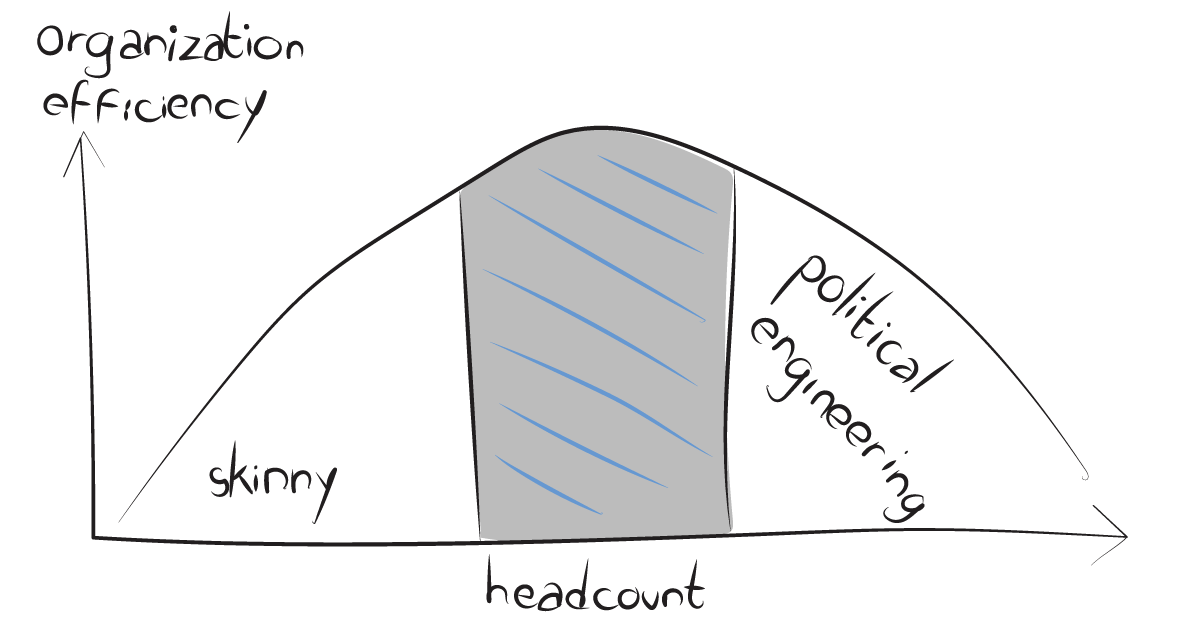

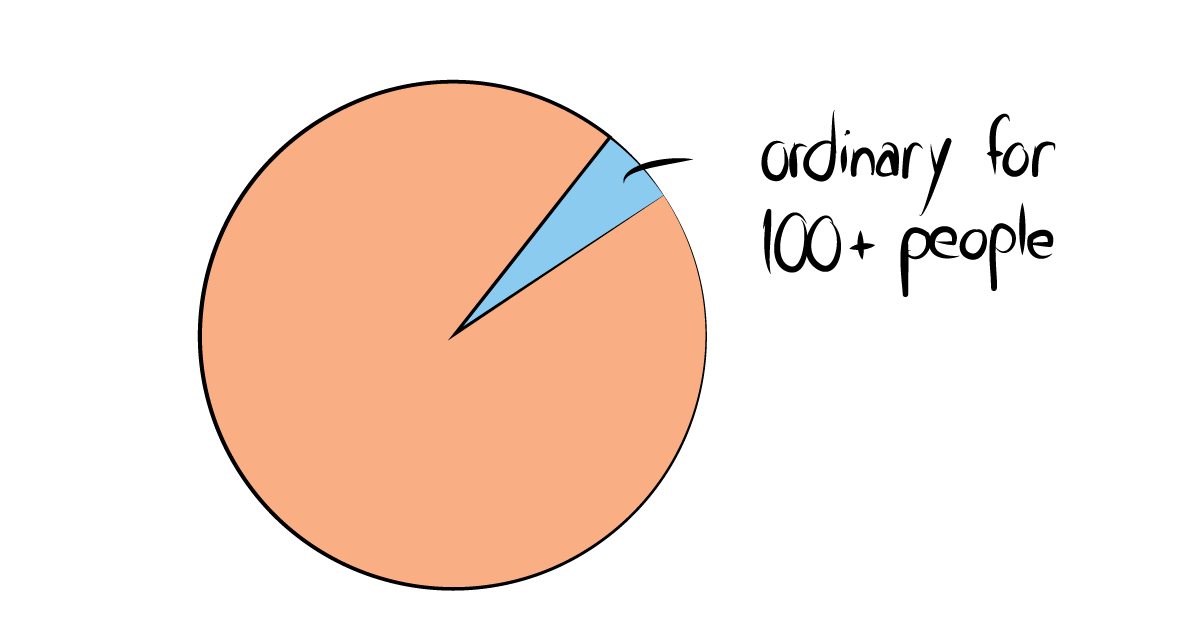

150-250 people are probably the ideal operational size

$100M of annual revenues is something to think about, and generally speaking, 150-250 people are probably the most efficient operation for sales, R&D, admin, etc. Many large companies realize that and break down their business lines accordingly.

”I never dreamed about success. I worked for it”

― Estee Lauder

The necessary evil with real innovation: regulatory approvals

I cannot think of any innovative idea that is 100% legal. By innovative, I mean something that was never done before. This means that if you’re truly innovating, get ready for regulatory time, money, and heart attacks.

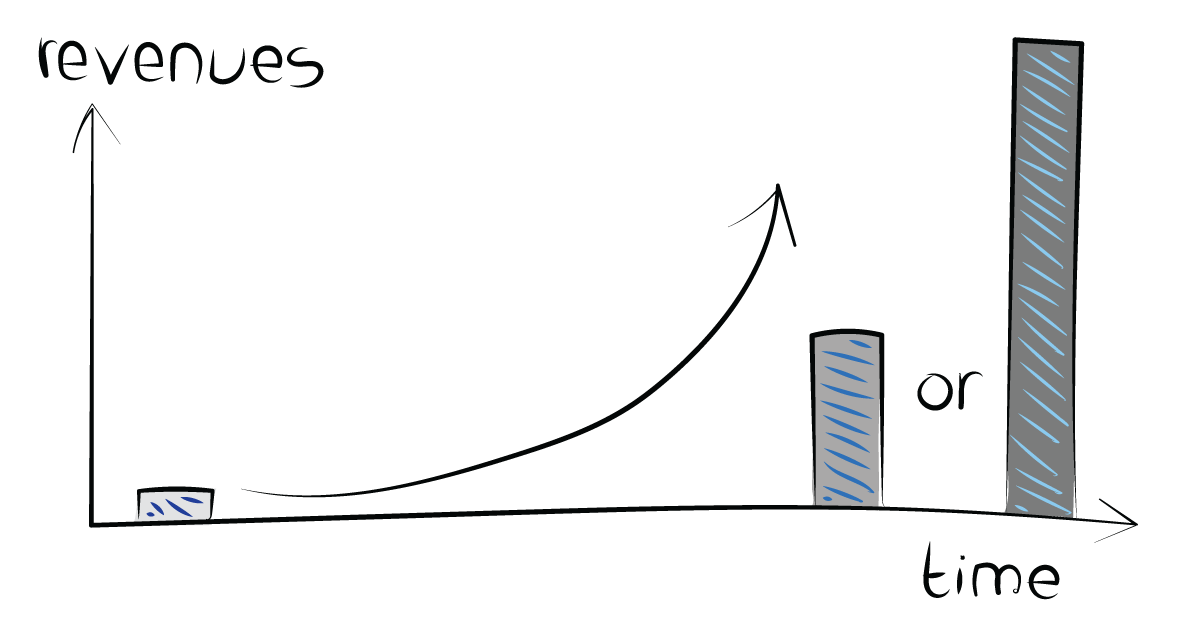

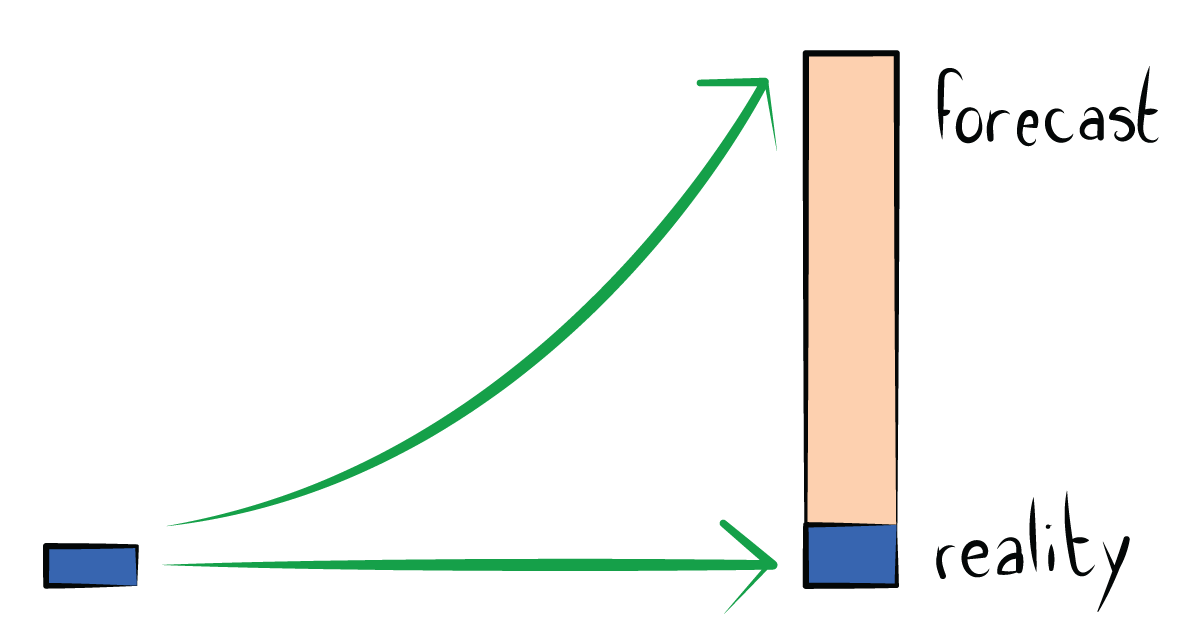

The bet you’re forced to take when investors tell you: “send me your business plan”

Both you and the investor know that forecasted numbers in your business plan are worthless. However, the revenues at the end of your plan (typically three or five years) should perfectly match the investor’s expectations.

When is the right time to hire the first salesperson?

The first sale MUST be done by the founder that knows and can improvise product and pricing details. Professional sales start when the product, customer, pricing, and marketing are in place.

What is the right typecast for the first salesperson?

An industry veteran with his vast experience and networking, or a promising young talent? Who should you start with? I’ll vote for the young talent as an employee and the experienced one as an advisor.

Always ask for “skin in the game” when doing proof of concept

It is risky and can kill deals, but asking for payment and a written agreement for the “what happens if it all goes well”, tests your partner’s hidden agenda when doing a proof-of-concept with you.

Exclusivity is a product, an expensive and complex product

The best way to get rid of exclusivity requirements is to tell the other side that exclusivity is a product. In other words – you’ll need to pay for it. And it’s an expensive and complex product.

Startups’ unconventional weapon to solve internal problems

Stock options can be a lot more than a financial asset, and it’s the other terms that can be used to solve many conflicts. There is endless creativity in the terms, so if you’re the one to suggest stock options as a solution, you’ll probably win (and vice versa).

Who is “the customer” if you want to sell to a massive company?

Surprisingly – “the customer” is a single person, not his group, and not a complicated org chart. Since your destiny in an extra-large organization is a single individual, work hard to find him, and take your relationship with him seriously.

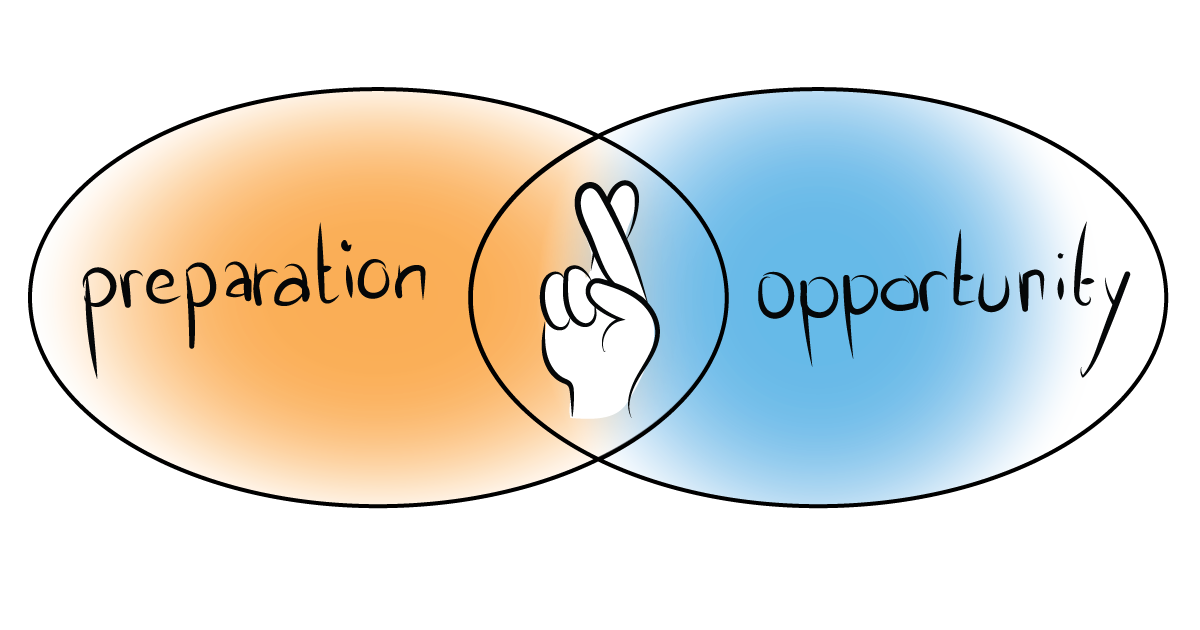

Roman philosopher Seneca: “Luck is what happens when preparation meets opportunity”

Don’t wait for luck to knock on your door. Place yourself, physically and virtually, where your targets are located, and be ready with sharp answers, backup materials, and explicit requests.

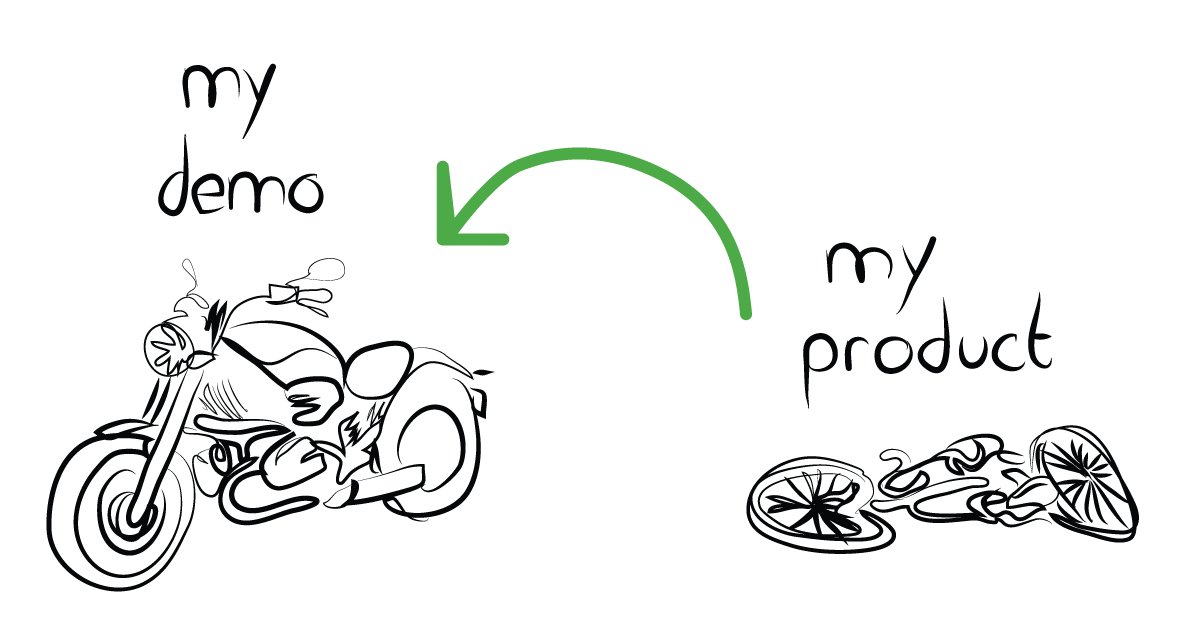

Demos should work 100% and look AMAZING

People that come to see your demo expect their minds to be blown away. They don’t come to imagine the potential. They come to see the present, and they expect it to be amazing.

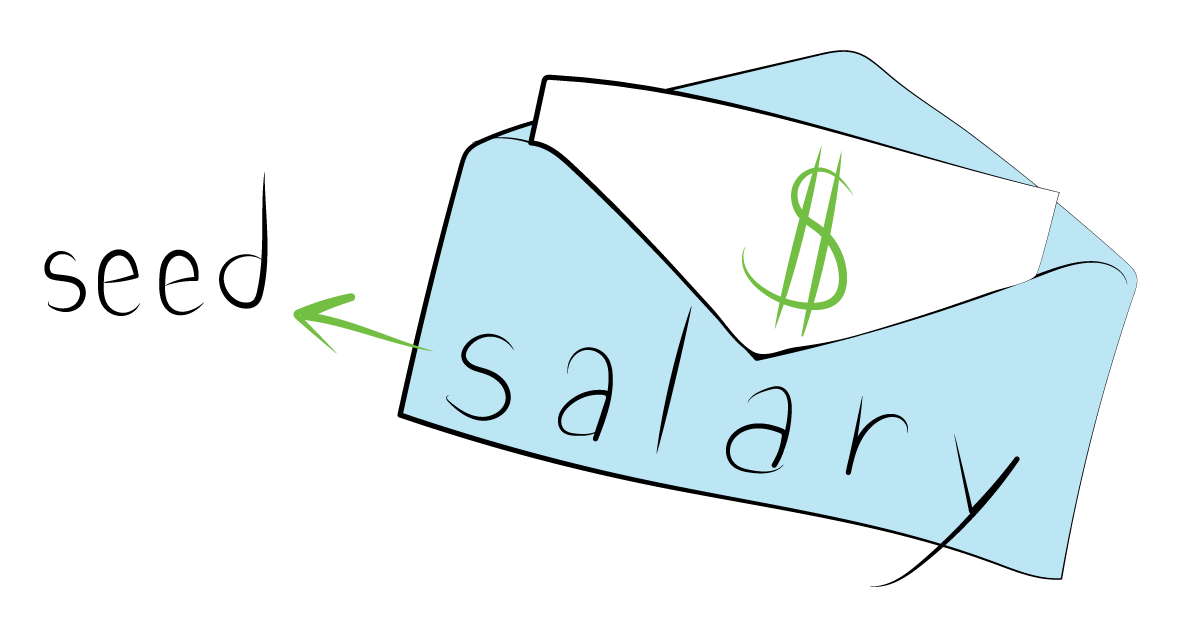

You may already have your very first investor

Nobody, except you, cares about your company’s pregnancy. You’ll invest considerable time and money before the company’s birthday (“…was founded at…”). View your current salary as an investment in your initial idea, and don’t resign too early – you’ll need this money.

Raise money when you’re strong

I’ll twist the “raise money when you can or when you need” to “raise money when you’re strong” for purely business reasons: with this timing, you can get a better deal. Don’t assume that having a strong business will last forever.

Why I like “Marry the Problem, Not the Solution”

In most cases, you fall in love with your product and not with your customer’s pain. It’s the customer’s problem that you should marry, not your way to solve it.

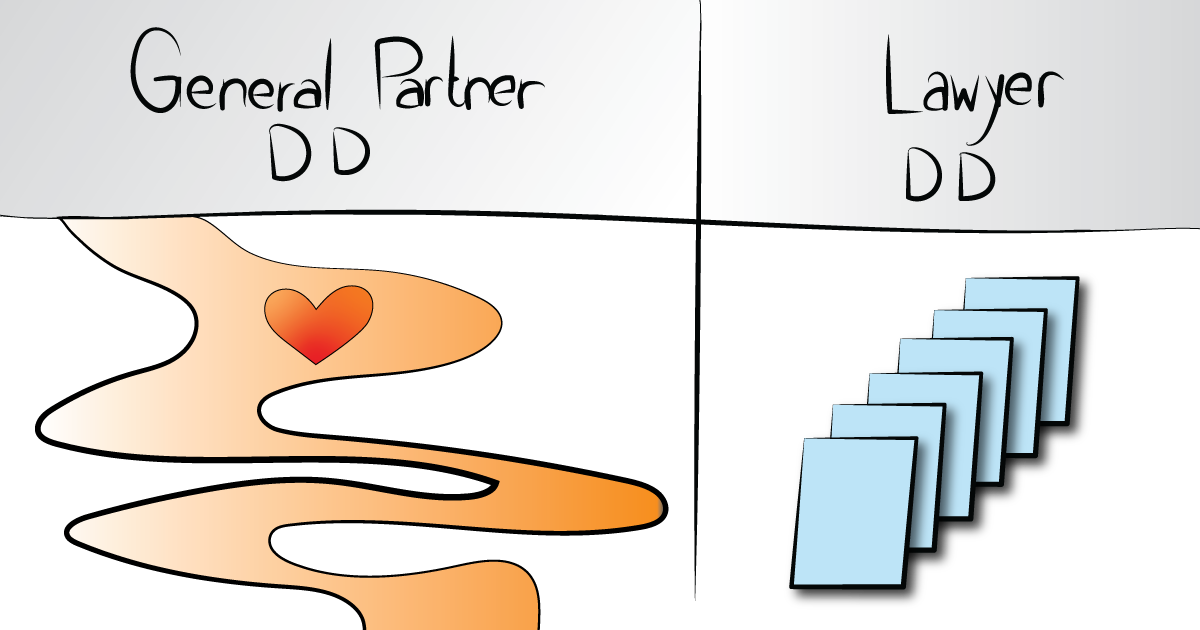

Two Due Diligences along the way, the important one and the formal one

As long as you’re not hiding any can of worms, the formal due diligence done by lawyers that go over your legal docs in the data room should not break the deal. Before receiving a terms sheet, the gut feeling of the partner with the mandate to say yes is the actual due diligence.

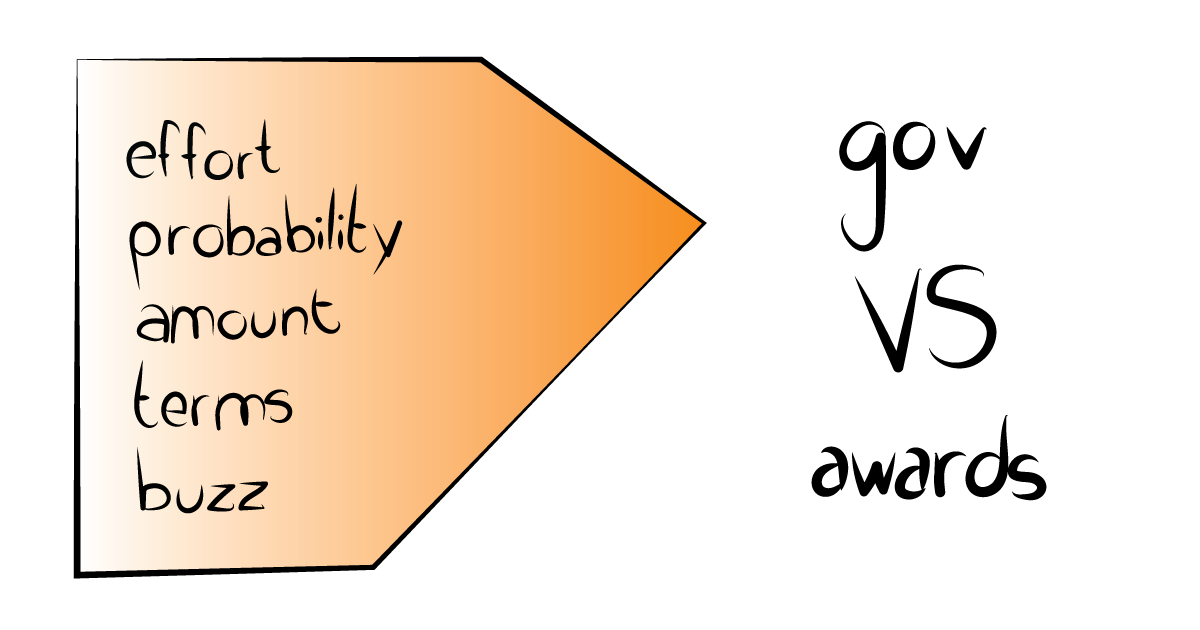

Why I love government grants, and why I hate awards

From a risk/reward perspective, government grants are mostly better than awards. Opportunistic submissions or outsourcing to a subcontractor won’t work. Go for the relevant non-dilutive, no-IP conflict, large grants, and focus on money, not perks.

Why I always smile when I hear “strategic customer”

You get the chance to collaborate with one of your market leaders. Immediate dreams about scalability, revenues, and even exit mislead you to work for free and allocate resources for this opportunity. Unfortunately, “strategic customer” ends with nothing in most cases.

Be careful with newsletters – this is an important source of information for your competitors

Your direct competitors respect you. So they monitor your progress and try to learn from your product and commercial updates. While your public newsletter is a gift for your competitors, it has a minor impact on your targeted audience.

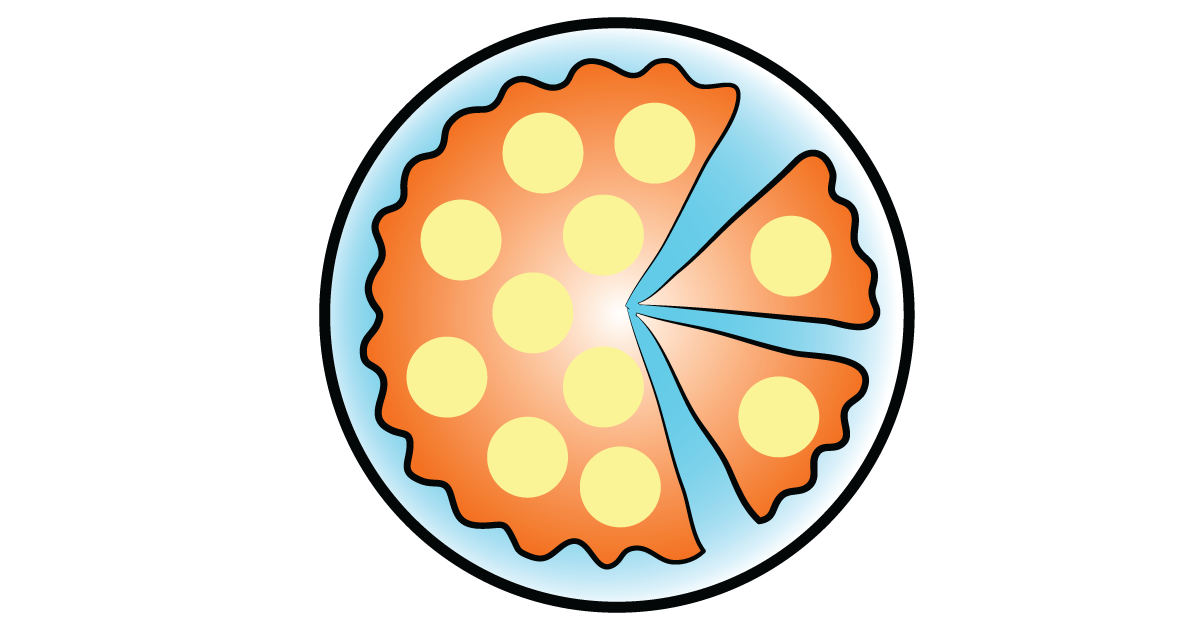

Fighting for a healthy cap table

Think long-term when it comes to your company’s cap table. Investors, employees, advisors, and contractors are eligible for some stake at the company, and fighting against their greed is tough. Make sure you sell reasonable stakes since fixing cap table mistakes is challenging.

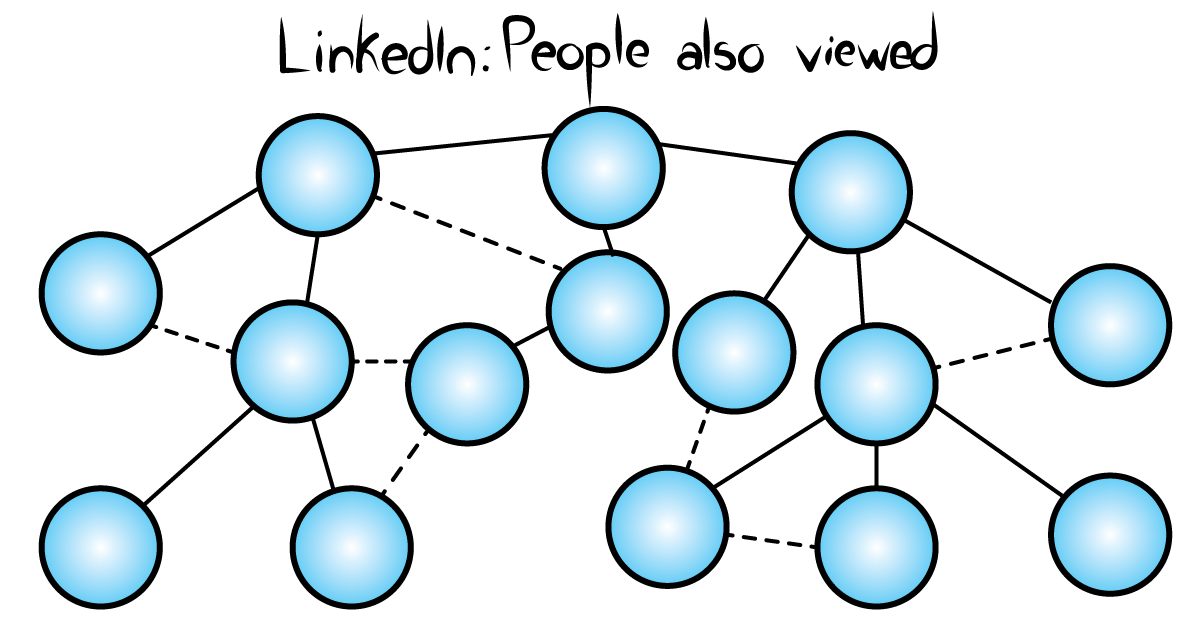

“People also viewed” in LinkedIn is a powerful tool to map organizational hierarchy

Mapping solid/dotted, formal/informal large organizational structures is an essential sales process as part of figuring out who is calling the shots. LinkedIn “people also viewed” is a good crowd wisdom trick for this mapping.

Look for self-made angel investors since you can learn a lot from them

VC money is not necessarily smart money, and angel money is not necessarily dumb money. Building relationships with experienced angels is valuable since they know the struggle and what it takes to build a product and generate sales.

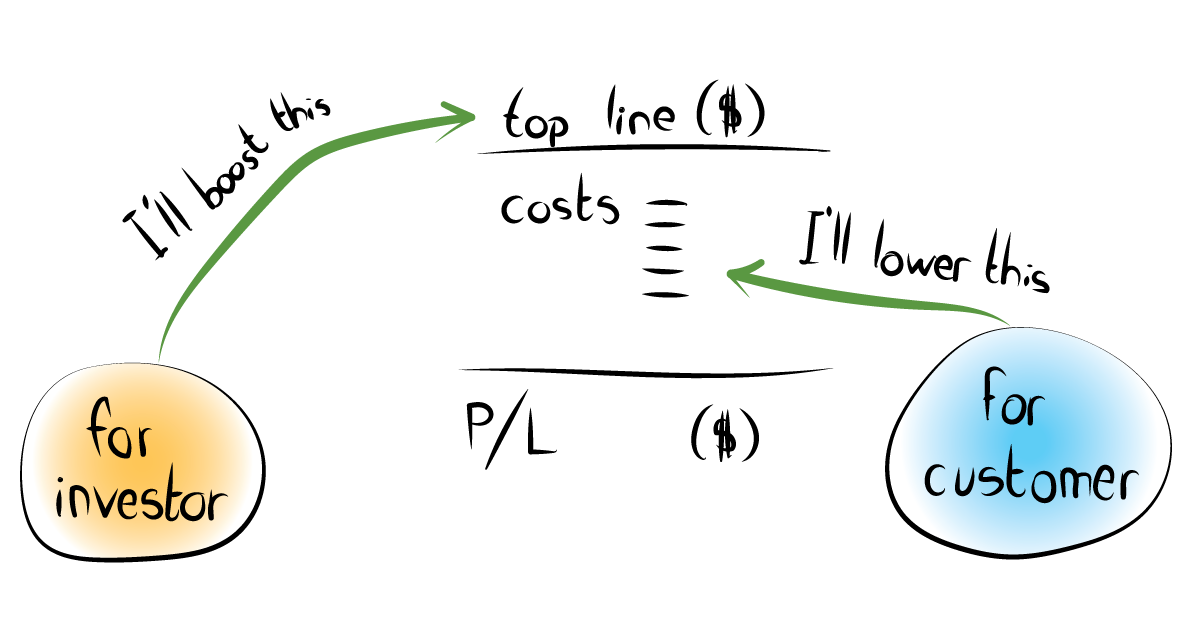

What’s a better pitch: I’ll increase your revenues OR I’ll reduce your costs?

Investors are excited about your product that will dramatically increase your customer’s revenues, while customers know how to measure their cost savings from a more practical perspective. So you’ll end up with two pitches.

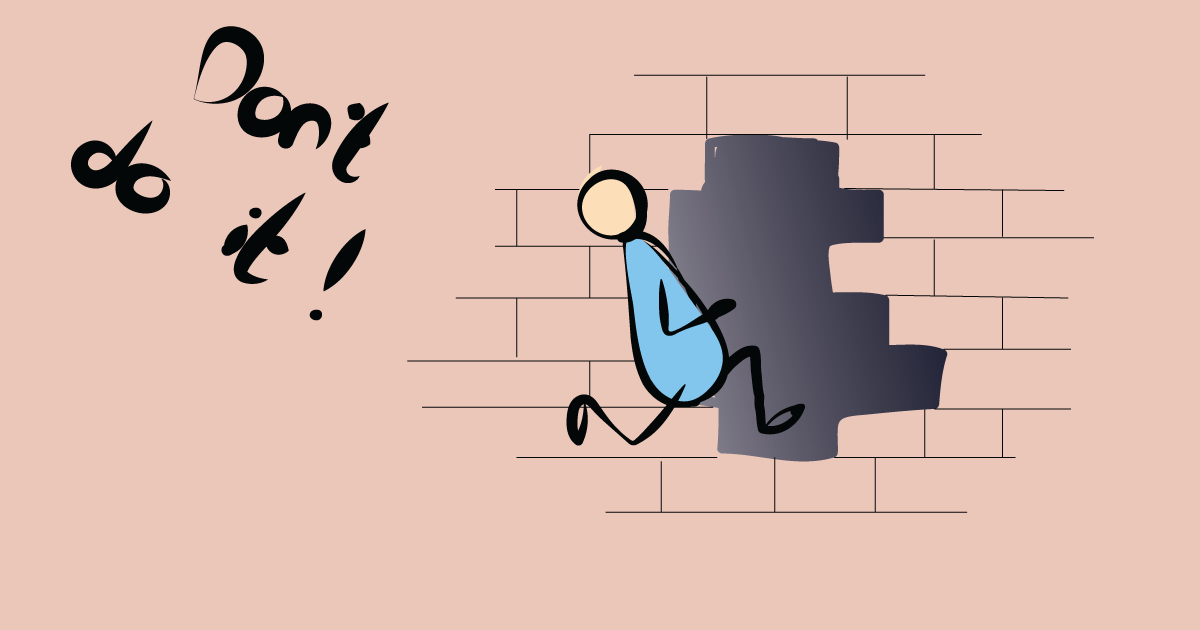

If you wanna start your business and Elon Musk tells you, “don’t do it,” Will you do it anyway?

Is it a rational decision to start a company, or is it simply the internal fire inside you that is just bursting out? Being passionate about your business means that you won’t listen to anyone telling you that it’ll fail.

The stickiness test and the time to say goodbye (and don’t wait, although it’s hard)

Love is not for sale, and the magic of having a team of talents giving their hearts and working days and nights is also not for sale. The downside of stickiness is finding yourself managing regular employees instead of wild horses. Refresh your team if you fail to achieve stickiness.

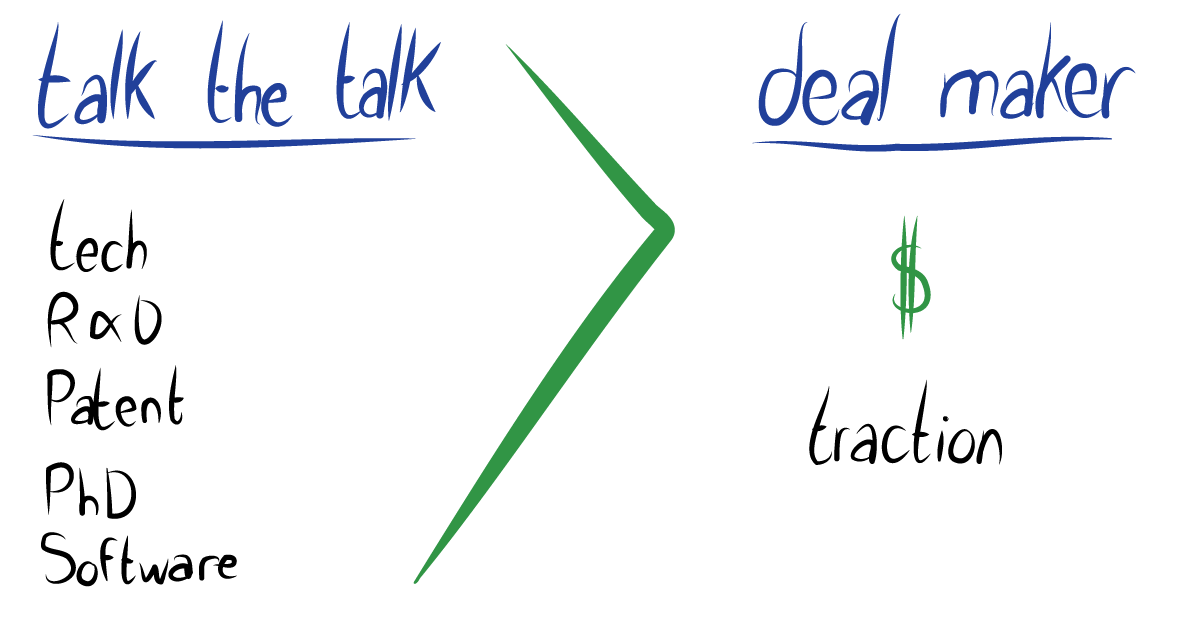

VCs invest in money-making businesses

Software or hardware, products or services, in any industry: if it’s a money-making business – investors will join and fuel. The public messaging around people, technology, or markets is misleading since dollar traction attracts investors more than anything.

Letter of interest/testimonial quote is both easy to ask and valuable

Surprisingly, people that empathize with your vision and roadmap will help by giving you a Letter Of Interest. And surprisingly, this short and non-binding document helps when you meet investors and show it as market validation.

”I can accept failure, everyone fails at something. But I can't accept not trying”

― Michael Jordan

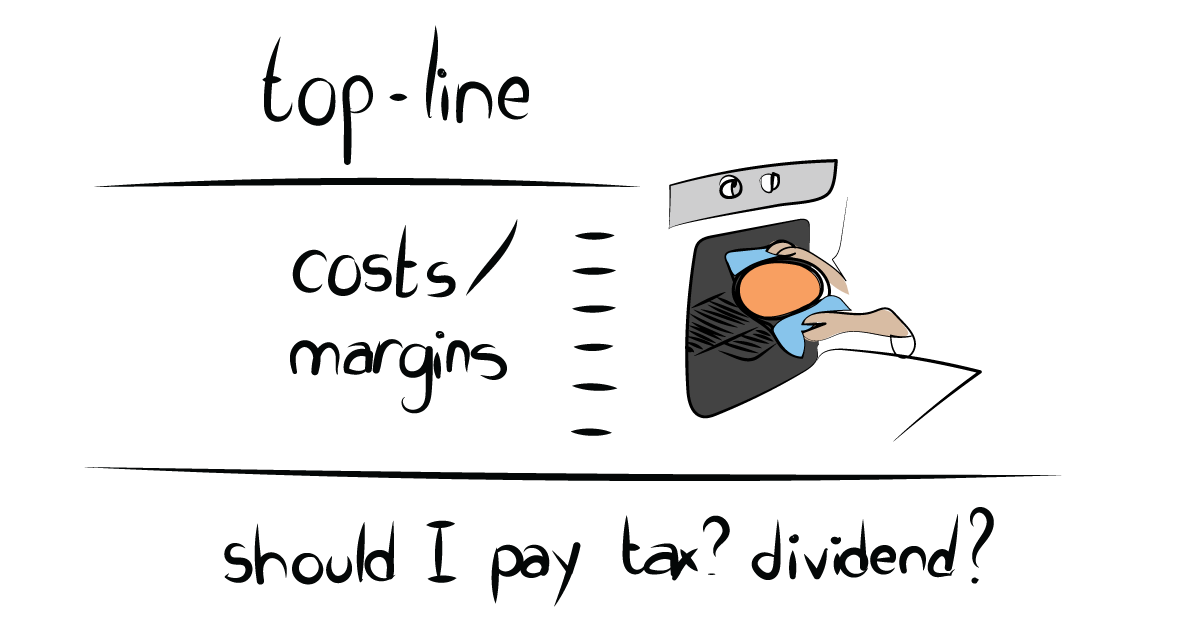

Bottom line: the real thing, or a “financial product”?

While the bottom line is the king for some people, it’s all about the top line for startups. Hirings and growth are considered manageable expenses. After a significant R&D period, tax is irrelevant. And the mindset is for increasing the share prices by accelerating growth.

Leaders are socially alone

If you are a social type of person and a strong team member, you lose a lot of fun when starting and running a company. In the beginning, it doesn’t sound like a big sacrifice, but over time, this loneliness is a heavy price you pay for your dream.

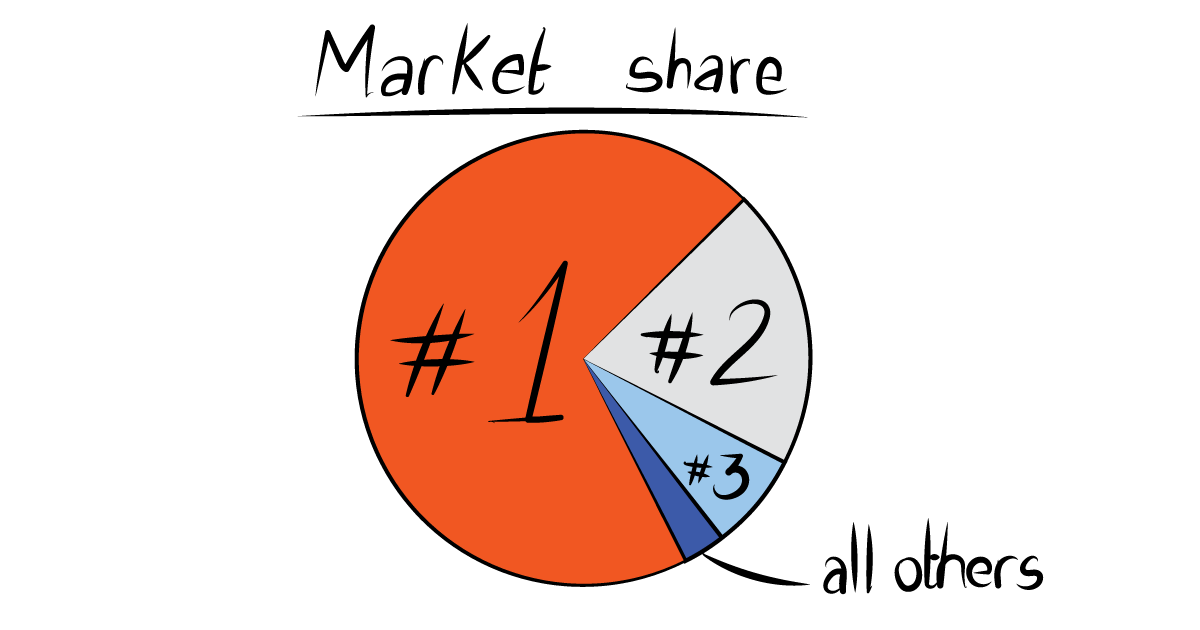

The winner takes it all: no room for #4, #5, etc.

The ultimate goal is to turn your initial domain into a new and massive market and lead this market. There is no such thing as “this is a billion-dollar market, so we can easily capture only 2% of it and make millions in revenues.”

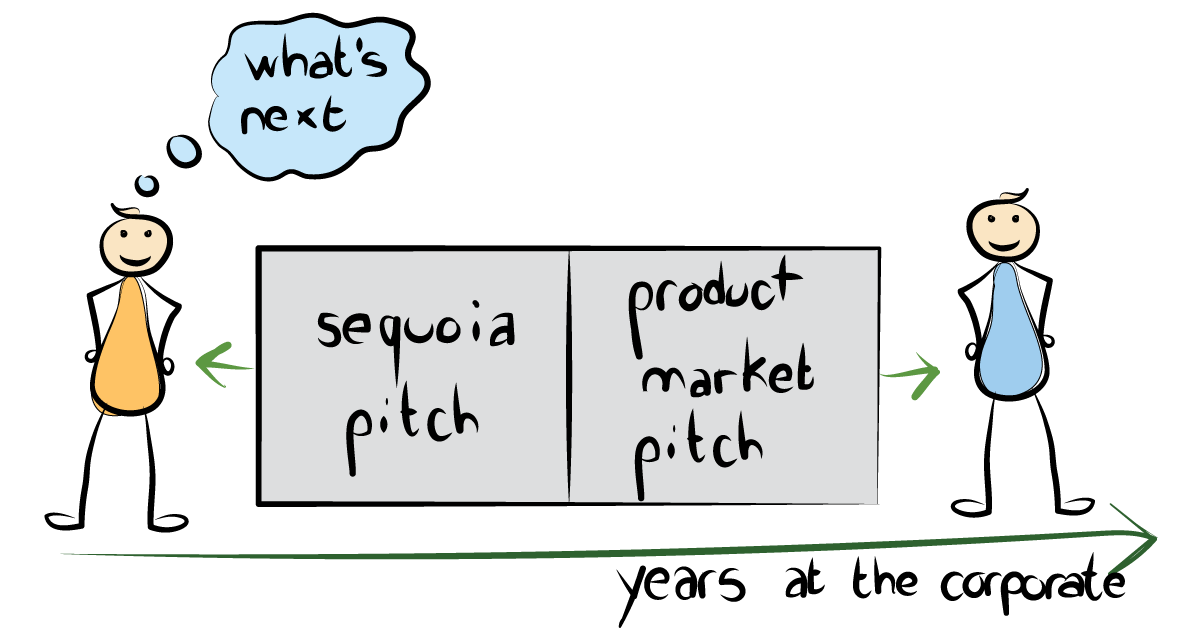

Two types of Corporate VCs

It’s the corporate VC person that is in touch with you: it can be a soul player – working many years at the corporate and an industry expert, or an MBA hitchhiker that will move on whenever it’s possible. It will be a different pitch process with them.

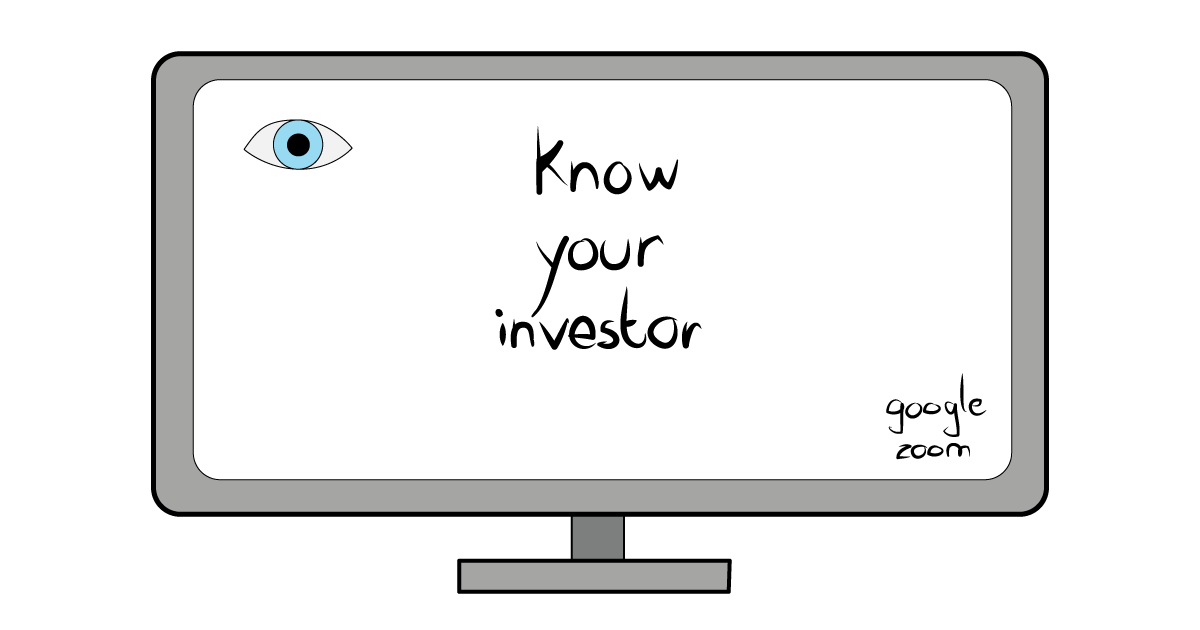

Identity check for investors

There are sophisticated scammers out there, and they will reach out to you, to try and steal from you. Google your investors, since who knows what you are going to find. And more importantly, don’t feel uncomfortable asking for a video conference to see their faces.

Team Technology and Traction (TTT) are not more than tools to make money

People want to hear about the team since it’s critical, and the same goes for the technology and the traction. But TTT is not the target. Making money is the target, and TTT are evaluated as “tools” to reach the goal.

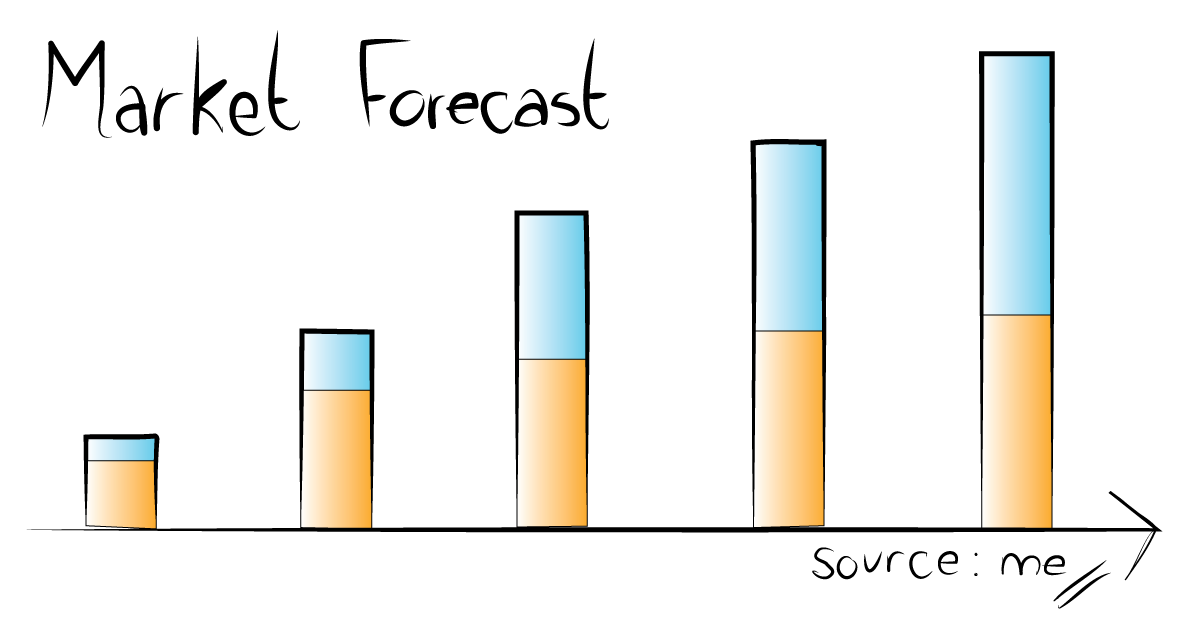

Draw your market projections to analysts and journalists

Analysts and journalists need market projections and news, so give the media what it wants and publicly create and share your market forecast with them. This increases your brand and positioning and attracts leads. And don’t worry, nobody will go back to check how you did.

The dark side of blue oceans

It’s a frustrating paradox: while it’s clear and publically stated that the next huge opportunities always come from new markets (blue oceans), if you innovate outside the comfort zone of current crowded buzz, you hear a lot of “out of my expertise”, “I can’t help”, etc.

Indemnification: commercially protect your worst-case catastrophe

Disclaimer: this is not a legal post about indemnification. It’s a commercial post about protecting the worst-case damages that bugs in your product may cause. It’s in your interest to negotiate indemnification terms.

Solving today’s problems is way better than futuristic bets

It’s about timing: today’s problem won’t vanish quickly, and tomorrow’s disruption is more likely to occur next decade. It’s less sexy and more competitive to work out today’s real problems, but customers and revenues are easier to get if you touch today’s pain.

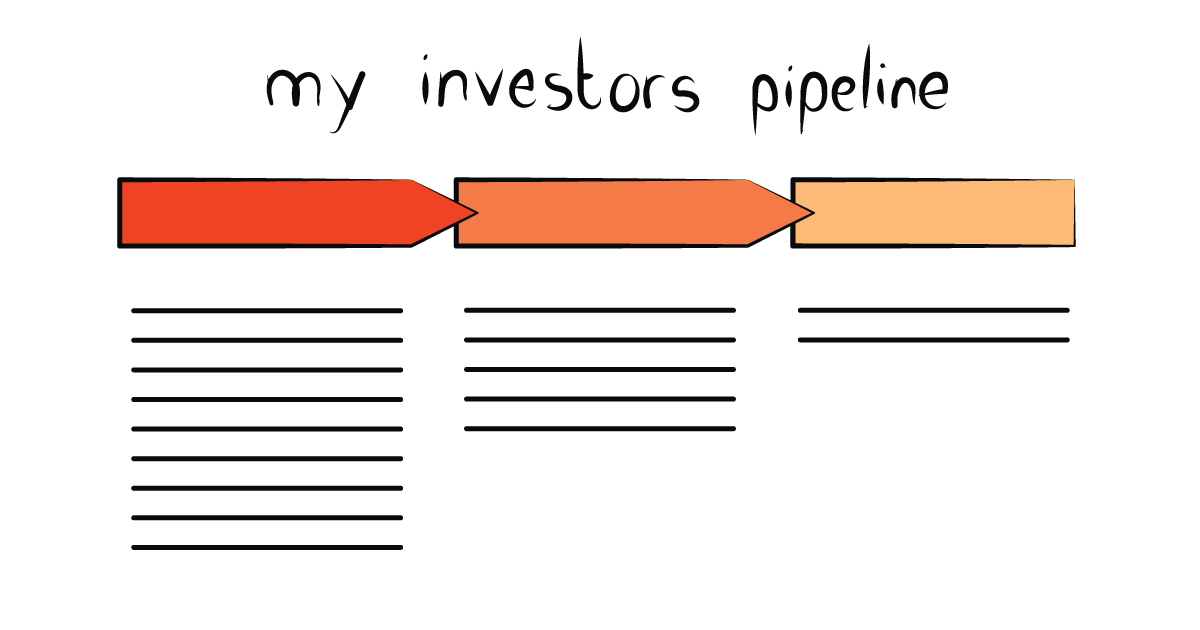

Since investors are your customers, treat them (seriously) like customers

Dedicate one CRM pipeline for investors. Email search, Excel, or calendar notes won’t work. Long term, you’ll find yourself exchanging information with hundreds of potential investors, and you’ll reconnect after being rejected, so manage this sales process professionally.

As a startup founder, be careful with your messaging to your family

Be very careful with your dream, optimism, and overpromising when it comes to your loved ones. Unlike many others, your family trust and care for you. Don’t break this down with trust or debt mistakes.

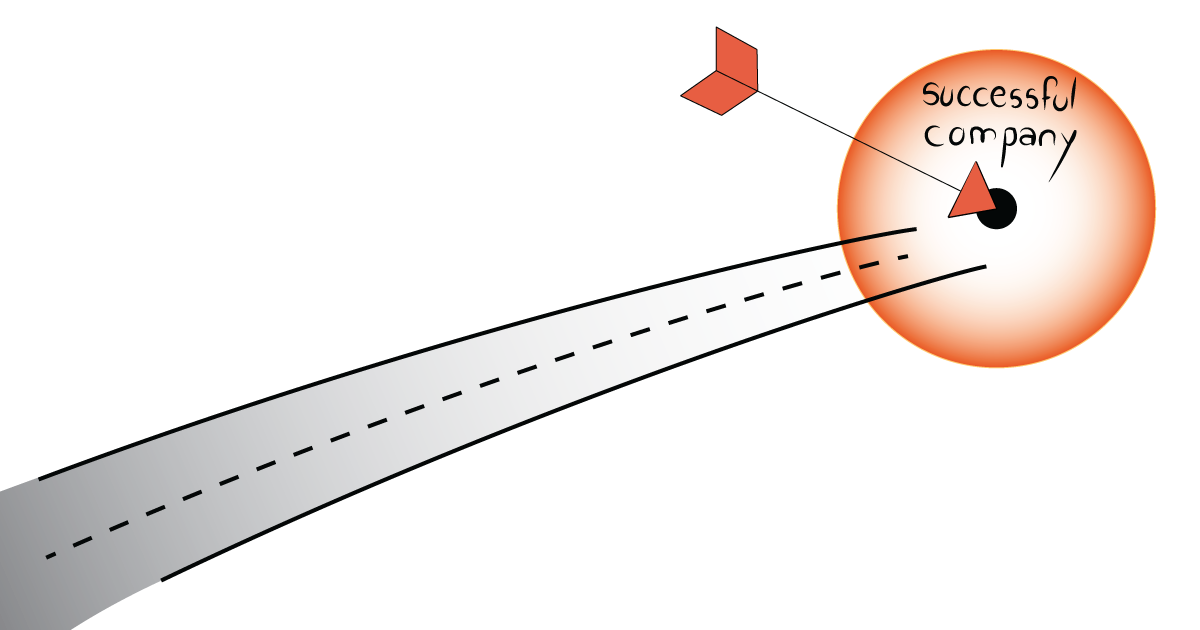

CEO life is simple :-), since there is only one thing to keep in mind

A successful company should not be the most important target of the CEO, it’s the ONLY target. Because of personal relationships with people inside and outside the company, decision-making for a successful company can be cruel.

CEO in the real world: Chief Execution Officer

“Executive” is for corporates (as well as being a “Chief” and an “Officer”). In your startup, immediately after the 1% of strategic formulation and decision making – 99% of execution comes. And execution is hard. Extremely hard.

Listening is the best source for valuable data

At scale, a nice-looking dashboard can support decisions and validate assumptions. With or without tons of data to analyze, always listen to everybody. Being so passionate about achieving your goals and emotional about your product makes listening tricky.

Overpromise, but not too much

You won’t be able to make it without overpromising. Don’t mix dreaming about the market versus promising, which is about your product under your control. The business logic regarding overpromising is time: how much time do you have to deliver. This gap is your opportunity.

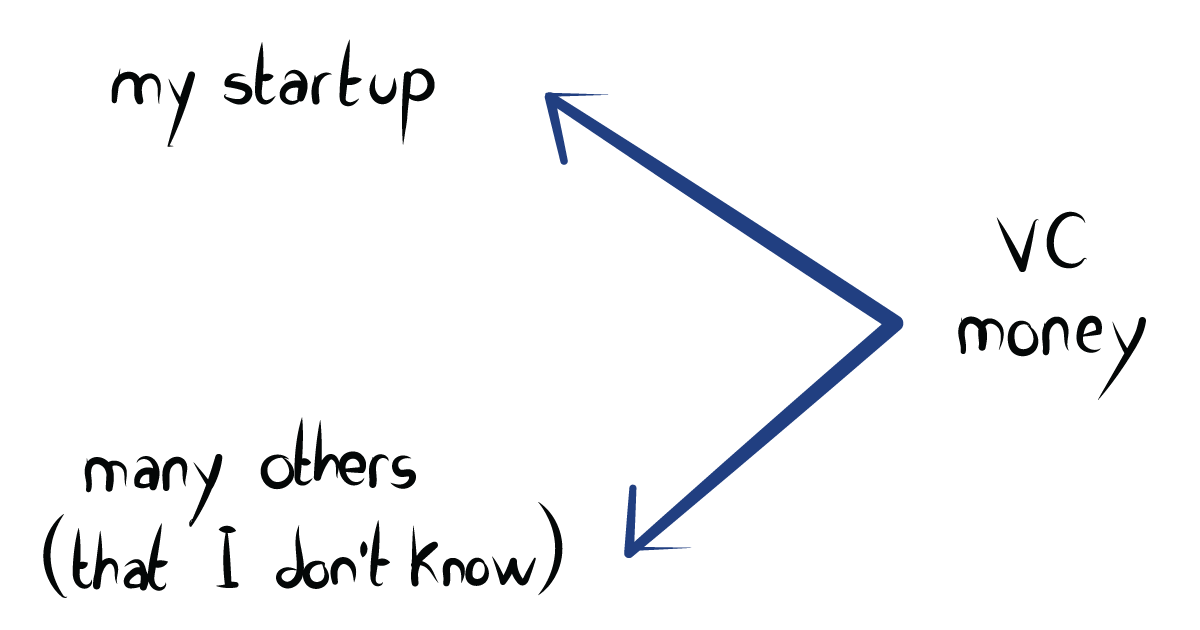

Competitors are other startups that you don’t know and also met the investor to raise funding

There is always competition when you want to sell, and when it comes to selling a piece of your company to investors, you fight in the dark against other startups that you don’t know. There’s not so much you can do about it.

Is there any “sustainable competitive advantage”

“Now, here, you see, it takes all the running you can do to keep in the same place.“ -Lewis Carrol. There is probably no such thing as the (desired) sustainable competitive advantage. No “safe haven”. However, it’s tough to fight against “unfair advantage”, or extra-large size.

Some market trends never arrive

Where are the autonomous/flying cars? And similar questions can be asked about AR/VR/Wearable computing and many other mind-blowing trends. Some market trends that make a lot of sense and buzz never arrive.

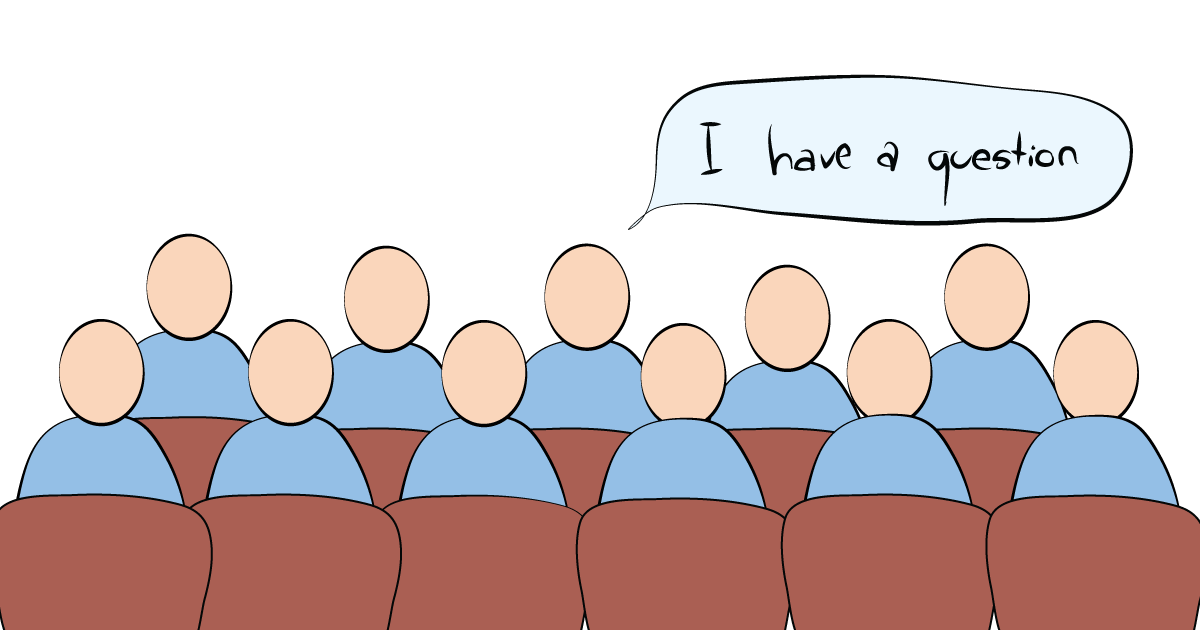

One thing to do while sitting in the audience at a conference

Here’s a powerful trick to step up while sitting as an audience in a conference: ask a pre-planned question. This gives you the chance to introduce yourself to others briefly and to be remembered by the host.

Press releases are (still) an effective marketing hack

Here’s some effective B2B marketing advice: the “formal” way of writing and distributing press releases still counts, so do it. Psychologically, investors and customers see it as a reputable signal, and it’s also effective for Google SEO. Technically, it’s both easy and cheap to do.

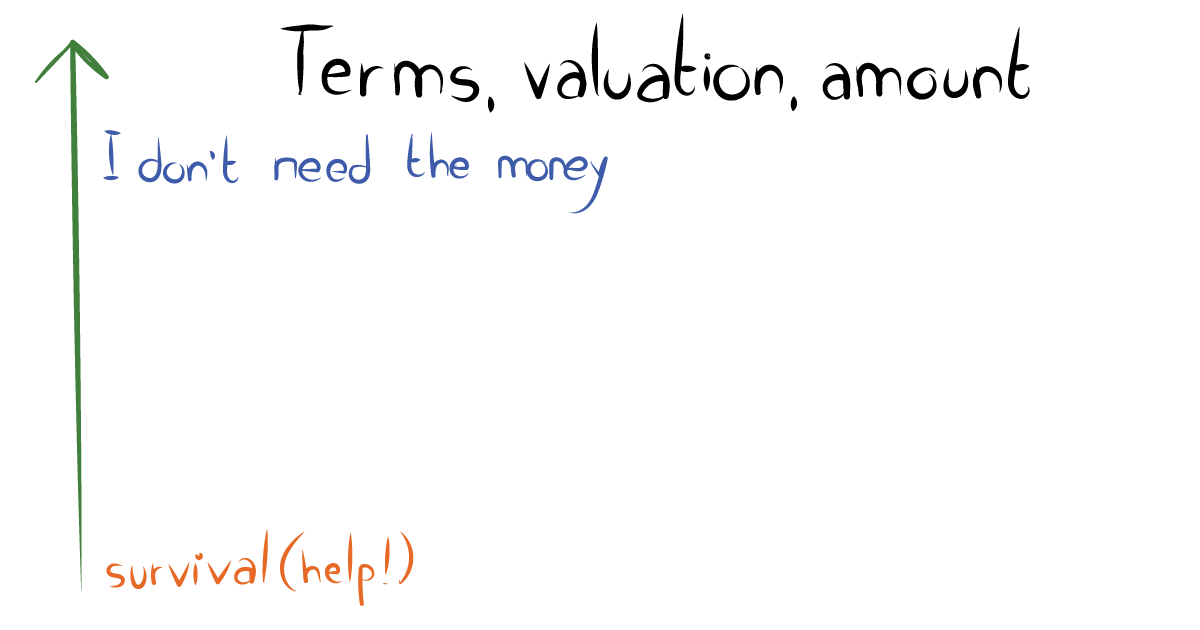

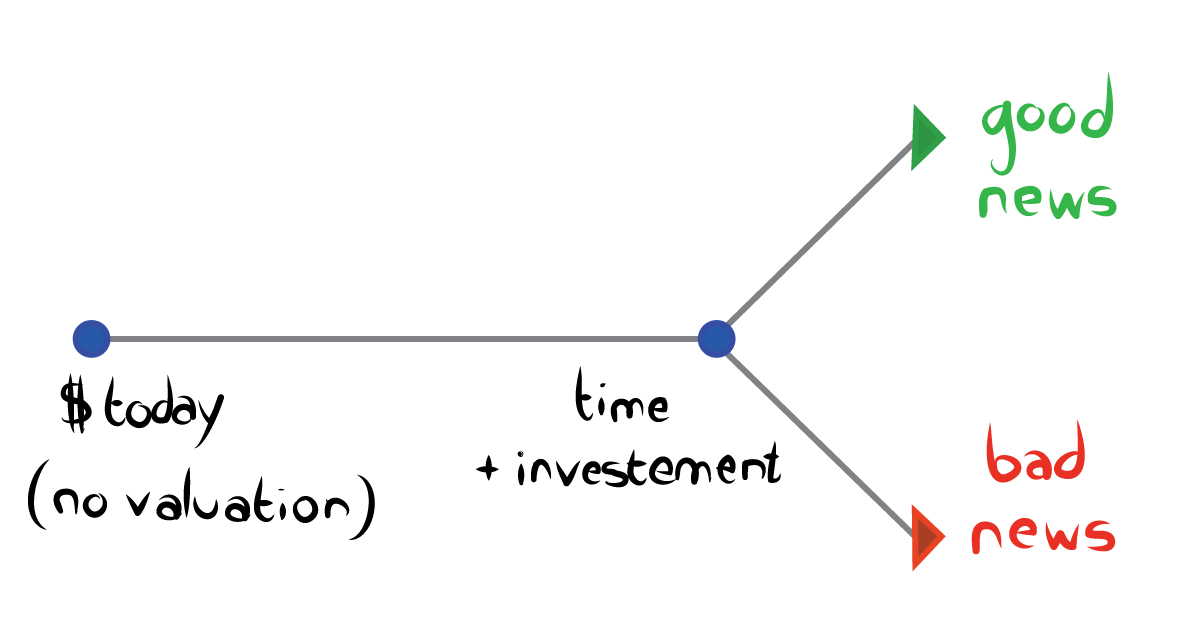

Commercial negotiation priorities when raising with SAFE

SAFE is not simple. What is CAP? Ask three people, and you’ll get at least three (correct) answers, such as protection, valuation, or only investor’s valuation. From my entrepreneur perspective, I’ll elaborate in this post on what’s worth commercial negotiation in this deal.

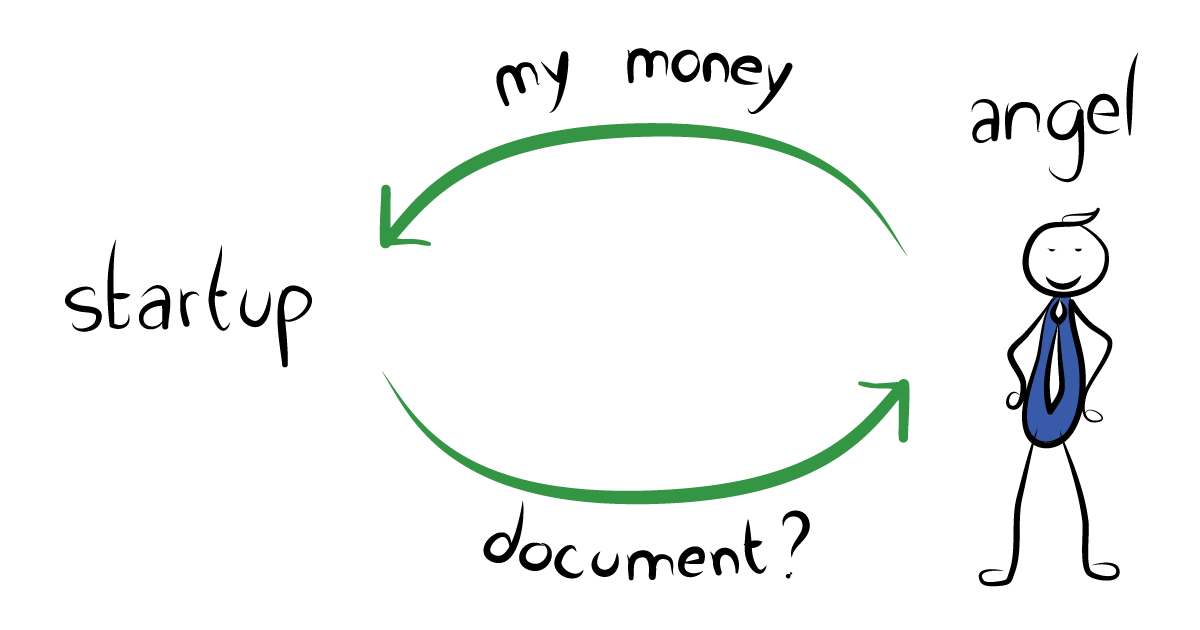

How to explain SAFE to the inexperienced angel investor

Is it a loan? No. How many shares do I get? You don’t get shares right now. When do I get my shares? It depends. What’s the company valuation? No valuation at this moment. How much percentage would I own? It also depends. This post is about how to explain SAFE to a newbie angel investor.

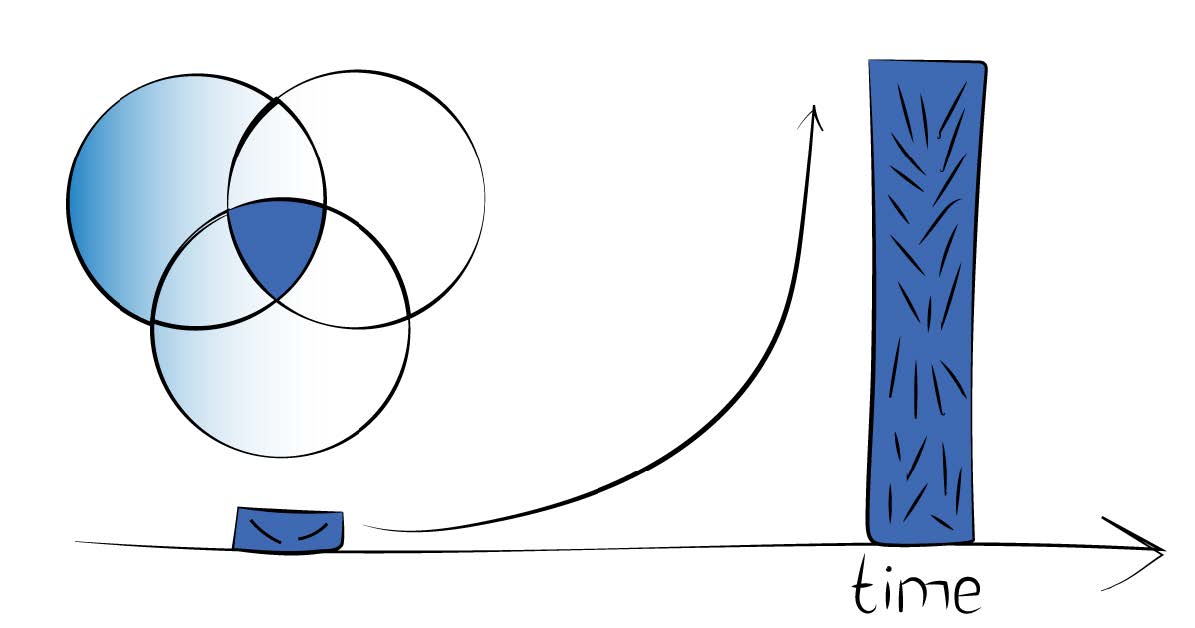

Growth-as-a-Feature

When the product and sales are ready, growth should be no more than a feature. However, there are two challenges with this “feature”: hiring massively and taking time from the money-in to the results-out.

Most investors are 40 to 60 years old. What does it mean?

You’re most likely to meet an investor who’s older than you and with some previous successful experience under his belt (at least as he sees it). What are the do’s and don’ts when raising from an individual who manages other people’s money?

Finder’s compensation: 5+5 is negotiable, a retainer is a scam

Finder’s compensation should be cash and sometimes warrants, which should make sense both in % and $. I highlight in this post six bullets that should be negotiated with the finder. Anyway, focus on buying and paying for door opening, not for anything else.

We work closely with our founders: a good thing?

While it’s reasonable messaging for anyone that manages Other People’s Money to justify his commission by saying to his investors, “we work closely with our founders”, it’s a red flag for the founders that need to figure out what’s standing behind this statement.

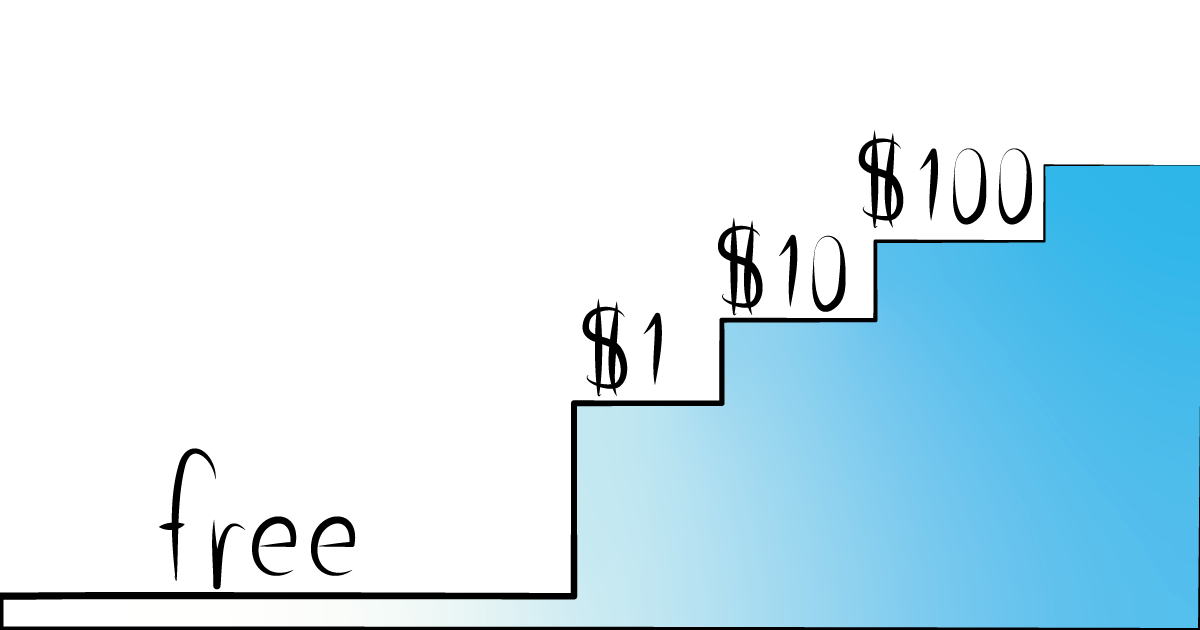

Making an early adopter a paying customer, even for a symbolic $1, is a huge mental test

Both for the seller (you) and the initial customers: a $1 payment is completely different from free, and a much better test for the product’s value, the buyer’s mandate and approach, and the mental commitment for both sides.

Does long-term vision matter?

With a dynamic market environment, as well as a never-ending internal crisis, should you spend some time dreaming and planning the vision? Probably yes – because a long-term vision is like a compass, and it gives focus. In this post, I also offer a helpful way to get to the vision.

This is why I decided to move away from a co-working space and relocate my company to a traditional office

The benefits and popularity of WeWork/co-working spaces are well known. But in addition to pricing, what are the downsides? As CEO, I decided to move away from this since I wanted to build my unique culture, boost productivity, and speak freely on my phone.

”Every day that we spent not improving our products was a wasted day”

― Joel Spolsky

What is (really) a market, and what is not

The market is not what you see in the Gartner/Forrester reports, and a country on the other side of the world is probably not a relevant part of your market just yet. The relevant market size and growth, and a crisp description of the market opportunity are essential parts of the business strategy.

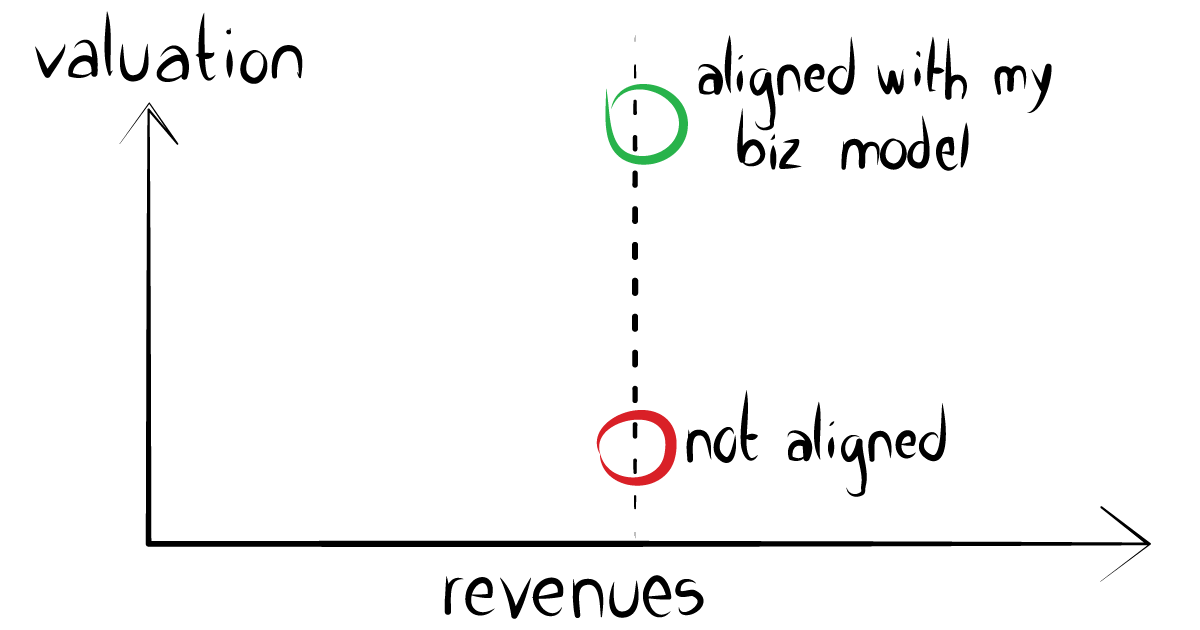

Focus on revenues that are perfectly aligned with the business model

It’s a valuation thing: two companies with similar status for their products, revenues, and vision will raise at significantly different valuations according to the source of their top line: customers’ alignment with the business model is a valuation booster.

$1B Addressable Market is ok (not too big, not too small), and CAGR is more important than size

Analyze and segment your addressable market to hopefully end up with strong growth (CAGR) and attractive size. $100M is a don’t-care niche market, and $100B means you don’t know your market, or it’s too late. You look for an opportunity to lead an emerging market.

Two golden rules for Board meetings

The two golden rules are consensus and no surprises. This is much easier said than done. No good or (more commonly) bad surprises mean preparation and offline discussions before the formal meeting. And consensus means no compromises for the benefit of the company.

An Important question about your product: nice to have, or a must-have?

A toothbrush is a fantastic example of a must-have product, while YouTube is nice-to-have, at least for me. Know the necessity of your product to your customer since there are significant product, pre-sale, post-sale, and liability differences between nice and must.

ESOP is almost a scam

If you’re super lucky to join Cisco/Facebook/etc. as employee #7, or #70 AND you’re able to survive there for a few years, then yes – your Employee Stock Option Plan (ESOP) makes you a millionaire. For all others, ESOP won’t end up with meaningful money in the bank account.

Should founders look for mentors?

There is a huge difference between smart advice that anyone can give you during a regular meeting versus a long-term relationship with a mentor that gets to know your personality, company, and market. The right mentor, formally or not, is a secret treasure.

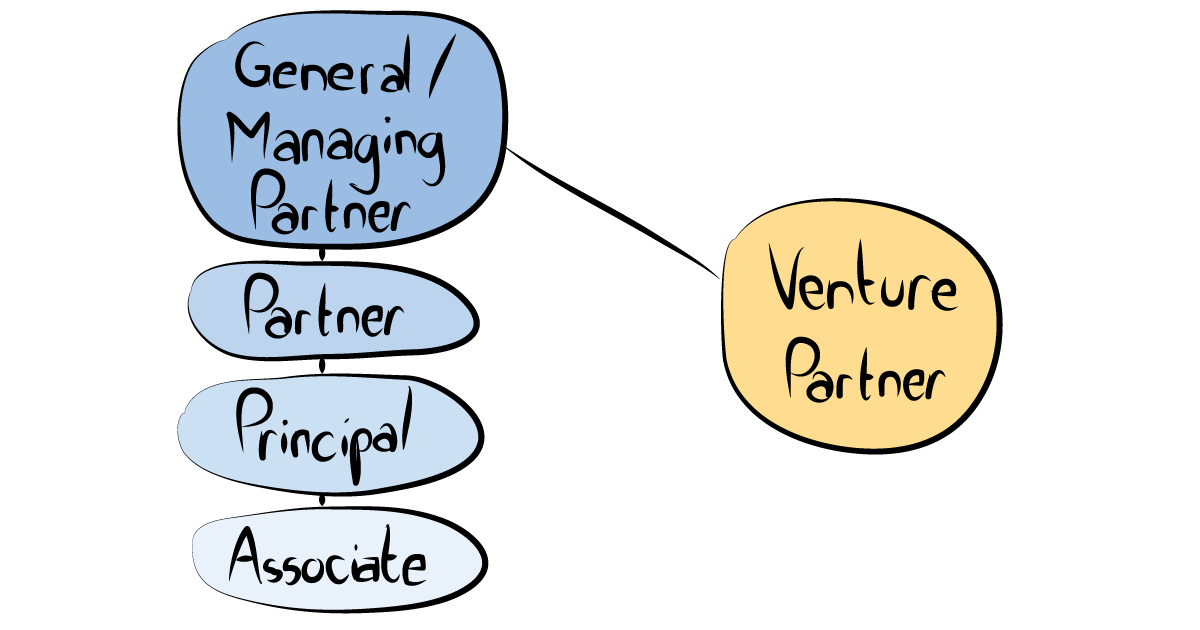

Venture Partner is the VC owner’s friend and an exception to the fund’s org chart

The typical VC employs few people and has a well-structured, deep hierarchy. “Venture Partner” is a semi-formal position for a member that the big bosses appreciate, so it’s useful for the founder to get him excited. His word bypasses the traditional process and hierarchy.

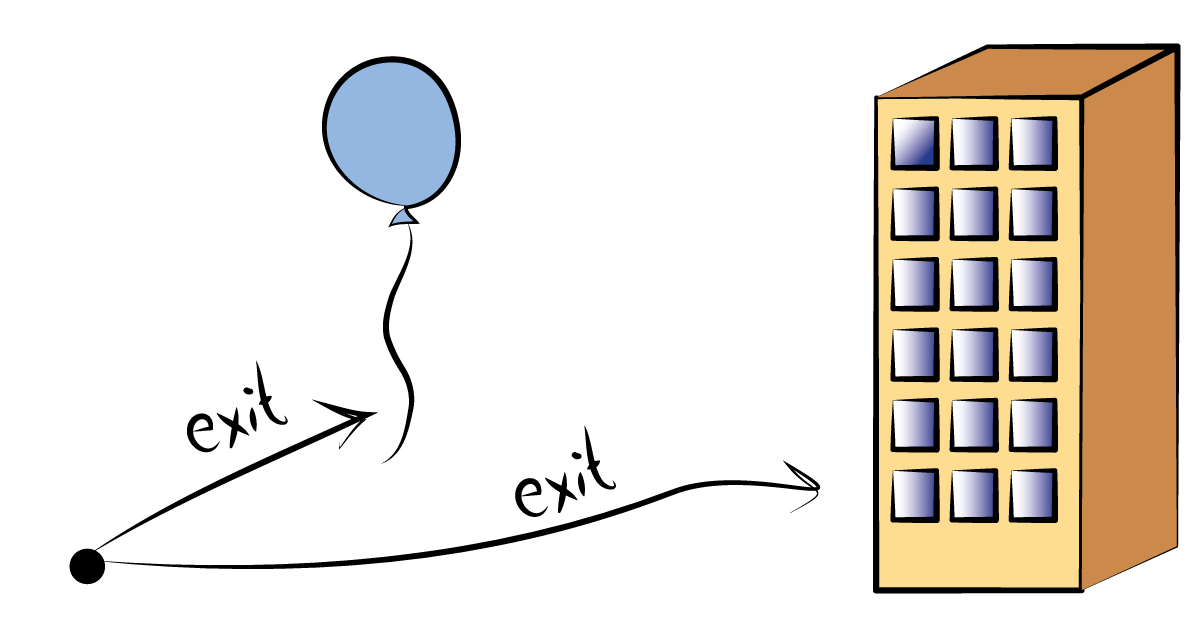

What’s your exit strategy: selling the dream with or without an operational business

Each successful exit includes premium pricing for futuristic dreams and plans. However, it’s a very different strategy to exit based on an operating business or not. Put shareholders aside, and align your exit strategy with your personality and vision.

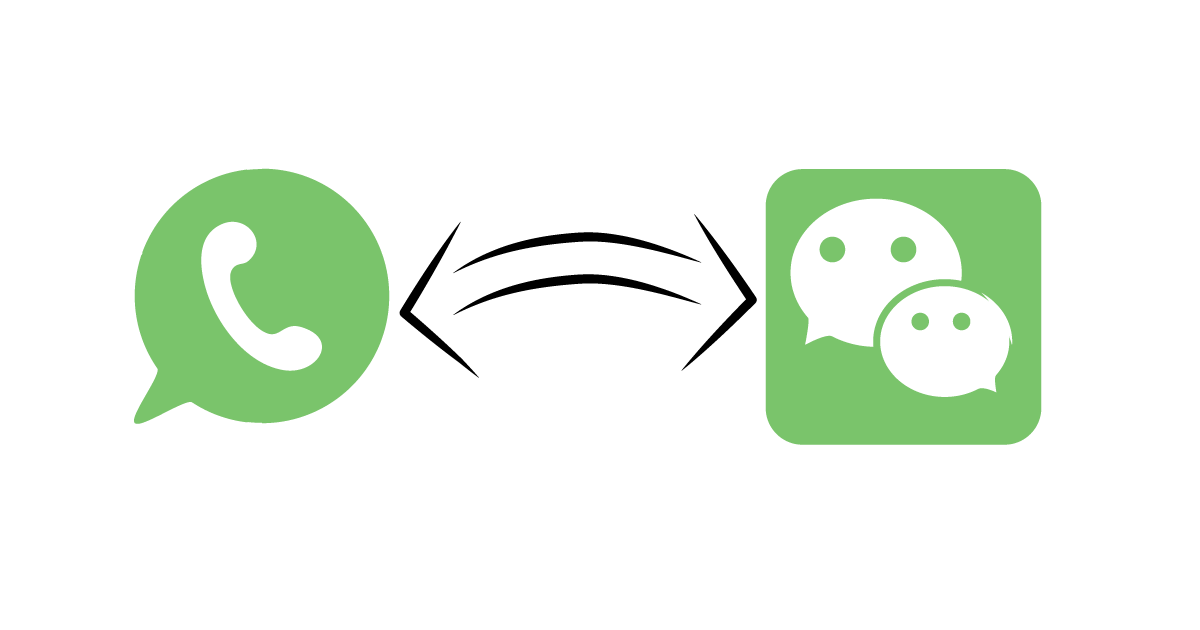

My experience with a hardware supplier in China

I never had a phone or a video call with my Chinese supplier. I don’t know the actual names of the wonderful people I worked with, and I paid a lot of money upfront. Trust and relationships were built over emails and WeChat messages. This may sound crazy, but it worked fine!

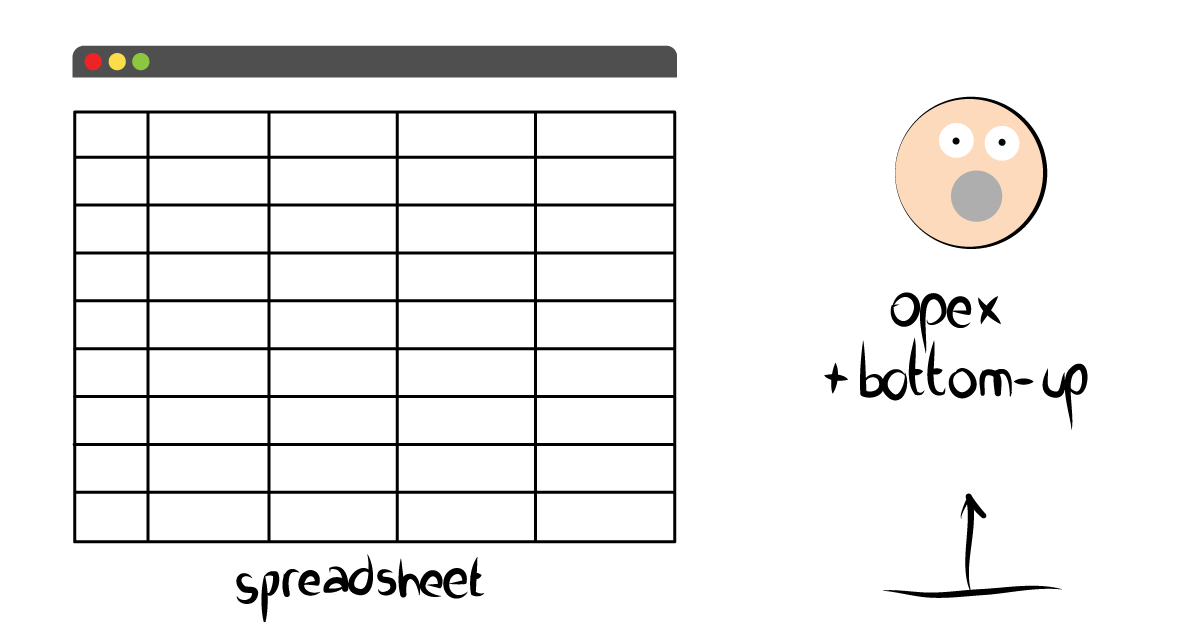

Why you should write down your financials in a spreadsheet – and why you should never share it

Writing down all of the numbers describing your entire company forces you to clearly define milestones, model customers, pricing, and sources of revenue, and you’ll also need to break down sales, product, and operational costs.

One minute of authentic videos, captured from your mobile phone, is the best

Nobody cares about how professional your marketing video is. We’ve all seen too many of them already. What’s eye-catching is authenticity! People want to see you talking, innovative technology that works, or a customer’s testimonial. Cut the bull**it and show what matters.

Always do the right thing

I truly believe in “always do the right thing”. “Always” is probably the #1 key since it tests decision-making during tough times. “Do” is #2 here since it’s about execution, not talking. And the beauty about “the right thing” is that you probably know what the right thing is.

If you take VC money, there’s no turning back

The VC business model is simple. Their goals and the path to get there are straightforward. So this package deal is more than taking their money. Be mentally ready to grow your company and spend a significant portion of your time and energy working according to the rules of their world.

Nobody cares how many slides you have in your deck

As long as the font is big, the message is simple, and the flow is reasonable – nobody cares if you have twelve or fifteen slides or if the team slide is at the beginning or the end. Forget about the endless rules and templates and do the pitch deck you think is the best for your customers.

The VC won’t tell you that his due diligence has already started

Each interaction you have with investors is part of their way to learn and evaluate you. You will not get any confirmation that the fund decided to take you seriously. The most important sign for you is to be invited to present to all of the partners.

The hidden motivation for social impact

Do a background check for your business partners, since if they made tons of money in the girls, games, or gambling industries, there’s a good chance that to clear their conscience, they’ll be interested in social impact. For all others, making the world a better place is just marketing.

Don’t ignore and don’t underestimate “termination” in legal agreements

We know Murphy’s law: “anything that can go wrong will go wrong”. Practically, this means that one of the last terms at the end of each contract that deals with termination should not be ignored. Understand and negotiate your worst-case scenarios.

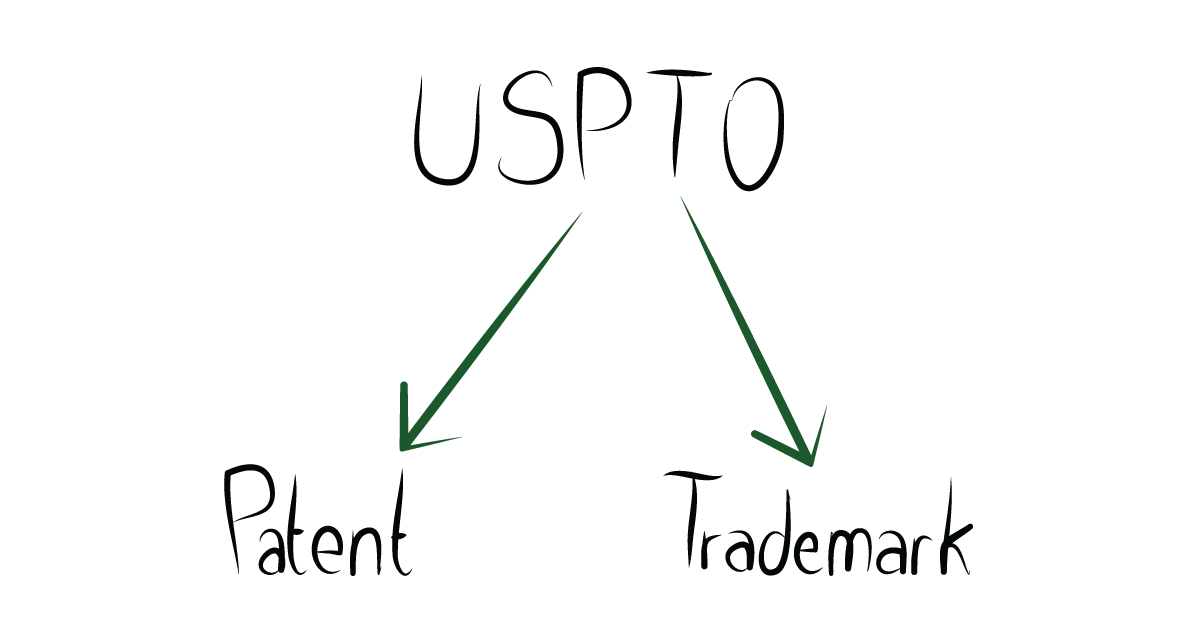

It’s ok to protect IP in patents, but don’t forget trademarks

Often, you hear about a company that “decided” to rename/rebrand. In many cases, it’s because of an underlying trademark conflict that was neglected on day one. The good news is that checking and protecting a trademark is much simpler and cheaper than filing a patent.

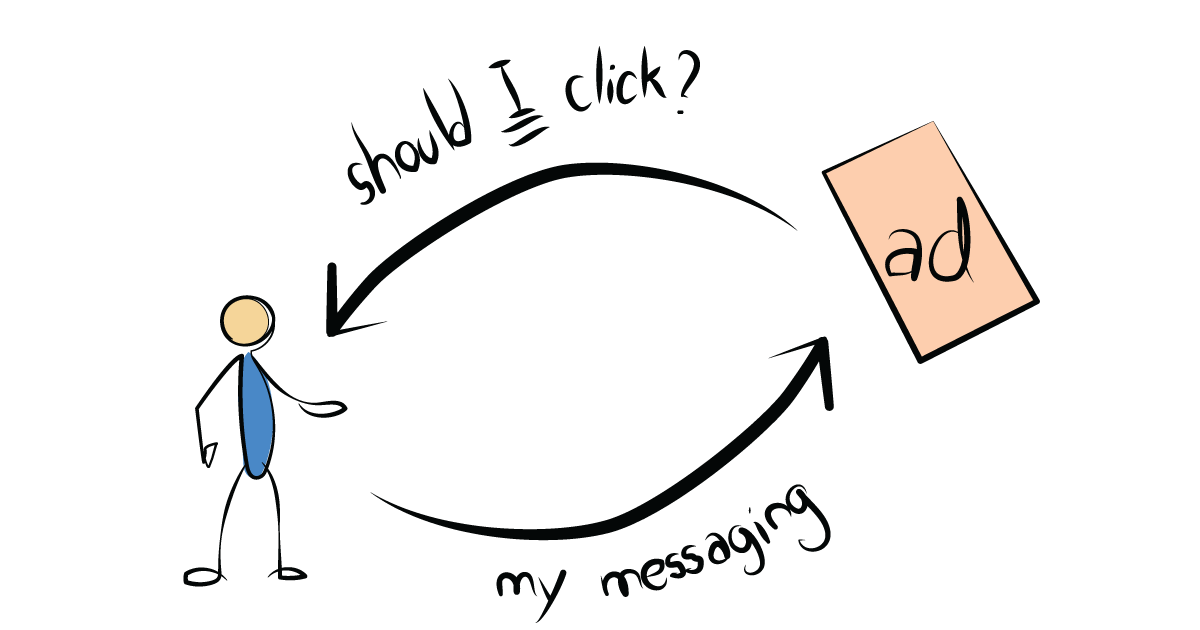

A strong marketing test

Should I click this link / buy this product / invest in this company / etc.? If you can be honest enough with yourself, this simple question is a compelling test for your messaging. The key thing here is I, not you, not the customer, market, or some imaginary figure.

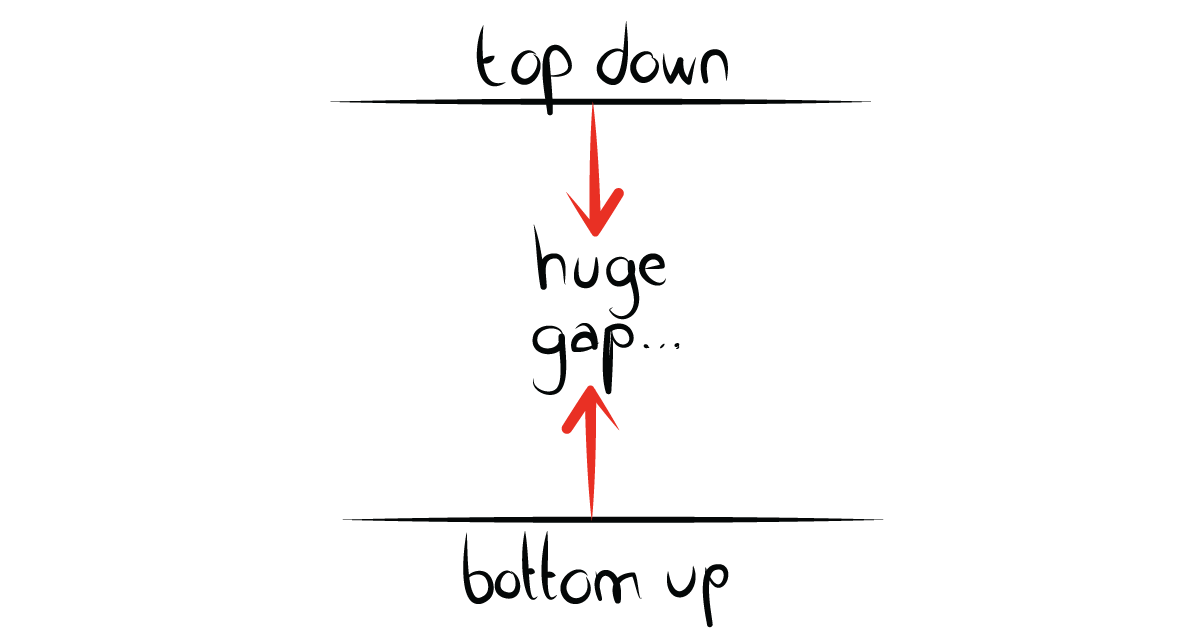

Are you a top-line or bottom-line type of person?

How would you forecast revenues? Strategic and marketing thinking is top-down, from market size to market share. On the other side of the world, sales thinking is bottom-up: multiplying products and prices. The gap between these two calculations is huge.

Founder is who you are, not your job title or what you do for a living

There is more than a job title here: you’re not eligible for a salary because you’re the founder, but because of some professional and operational work you do to grow the company (CEO, COO, CTO, etc.). Founder is relevant background, but NOT what you do for a living.

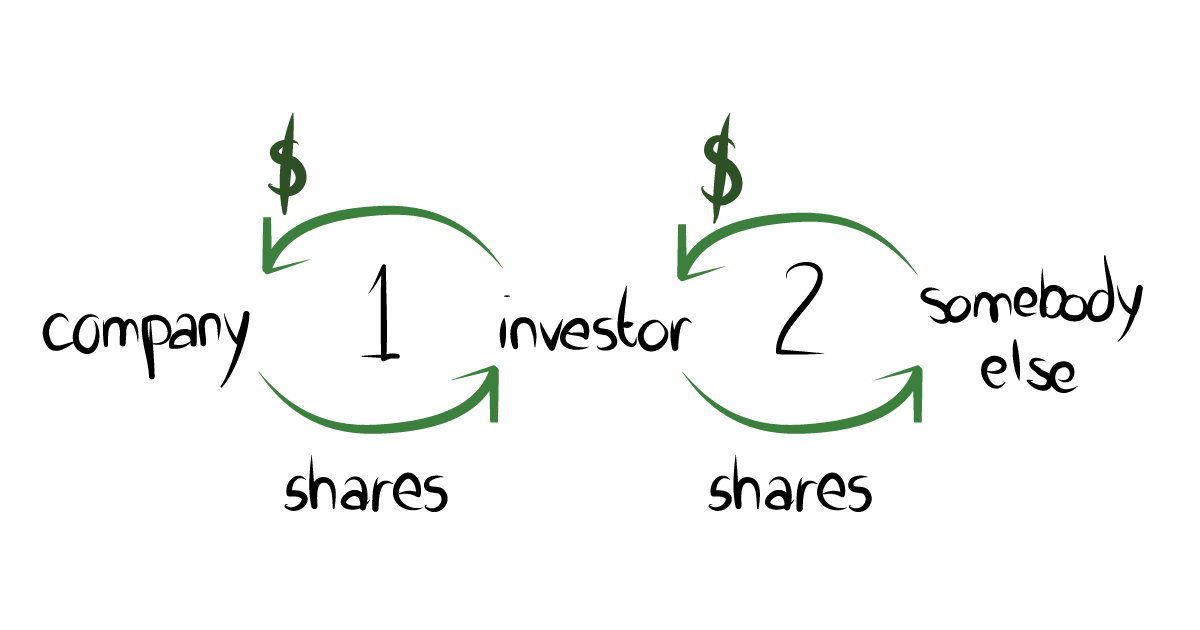

What is the product that investors buy (hint: and hopefully sell)?

Investors buy equity and sell equity. It’s as simple as that. The #1 reason they invested is not liking you or your technology/market, and not to manage the company or evangelize its vision. They’re here for the money, and that’s fair enough, so talk to them according to their interests.

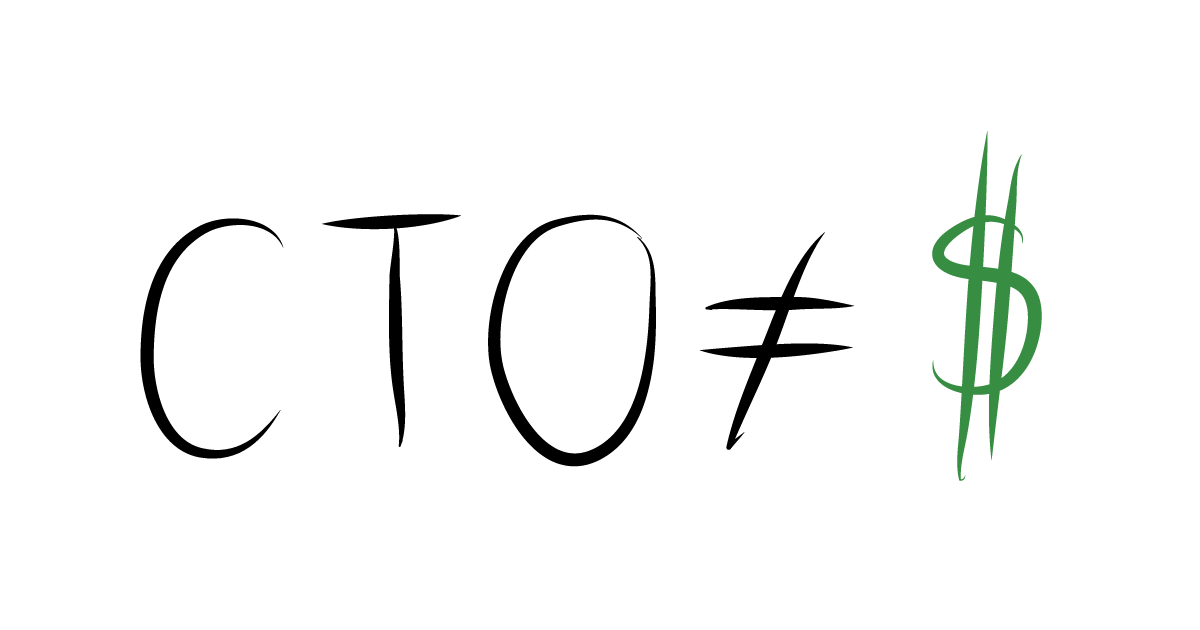

Investors talk but don’t (and shouldn’t) care so much about technology.

When was the last time you saw an investor answering panel questions regarding financial returns? Probably never. Investors’ comfort zone is high-level talk about things out of their profession. Engineers disrespect this approach, so investor-CTO communication is dangerous.

Every VC wants to be “Sequoia”, but very few can mimic one of their most important differentiators

Big money wins, eventually. The “David and Goliath” story is indeed inspiring, and miracles do happen. Still, a $100m check from one of the top-tier “Sequoia” funds is an “unfair advantage” that will likely kill all of the competing startups around.

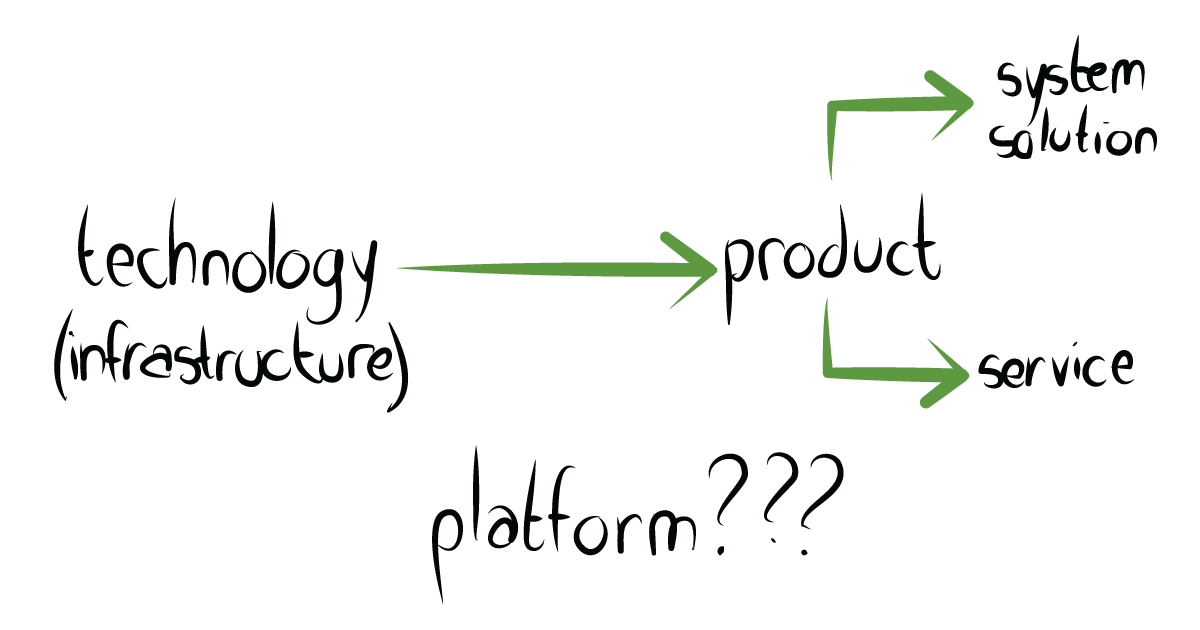

You don’t go to the supermarket and buy “platform” or “technology”

Engineers talk about technologies and marketers about platforms, but customers understand and pay for products and services. This is true for both B2B and B2C.

Can you drop everything and just go to sleep? it’s an important mental test

One thing they won’t tell you about being a founder is that it’s not healthy, and it’s not a joke. Every executive position means stress, but as a founder, you’re also very emotional about nurturing your baby. Work on being able to drop everything and just go to sleep.

Will you sleep well at night with X millions in your company’s bank account?

Money in your bank account means responsibility, so what is the ideal company size for you to manage? And how much responsibility can you carry on your shoulders? You should know the answer to these questions.

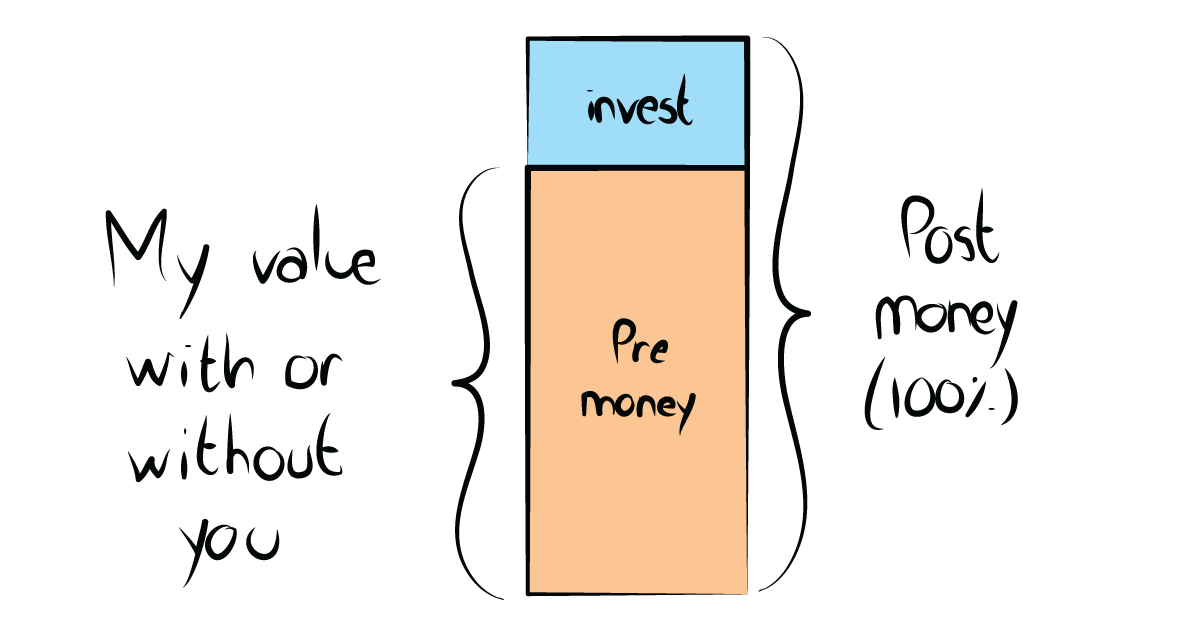

Always talk pre-money valuation, never post money

Pre-money valuation is how much is the company worth right now with or without investment. Investors may try to negotiate based on post-money valuation, which is particularly good for them if they decide to put in more money or bring in more investors during the round.

A Good finder should lead you to two or three new business opportunities

Generate your legal and commercial template, and work with multiple success-based finders. Their pre-meeting briefing, arranging a face-to-face meeting with a decision-maker, and follow-ups are worth a lot.